Indulge in the boundless possibilities of managing your finances with a tool that opens doors to a world of convenience and control. Discover the advantages of a versatile instrument that empowers you to embrace a lifestyle unencumbered by traditional banking constraints. Unveiling a realm of financial independence, a prepaid card offers an array of benefits that redefine the way you approach your monetary transactions.

Immerse yourself in the realm of financial liberation as you escape the confines of archaic banking practices. With the power of a prepaid card, you are no longer bound by the chains of credit checks, overdraft fees, or excessive paperwork. Embrace the efficiency and simplicity that comes with a tool designed with your needs in mind.

With the utmost convenience at your fingertips, a prepaid card allows you to seamlessly navigate a vast network of global merchants. From swiping your card at the corner store to completing online purchases with a mere click, experience the ease of a transaction process that transcends borders and cultural barriers. The versatility of a prepaid card ensures that you can effortlessly access your funds, whether you're at home or traveling abroad.

Embrace the epitome of financial empowerment as you embark on a journey towards a secure and dynamic future. The inherent security features of a prepaid card enable you to confidently manage your expenses with robust fraud protection measures, safeguarding every transaction. Revel in the freedom to track your spending, set financial goals, and cultivate healthy budgeting habits, all while enjoying the peace of mind that your hard-earned money remains secure.

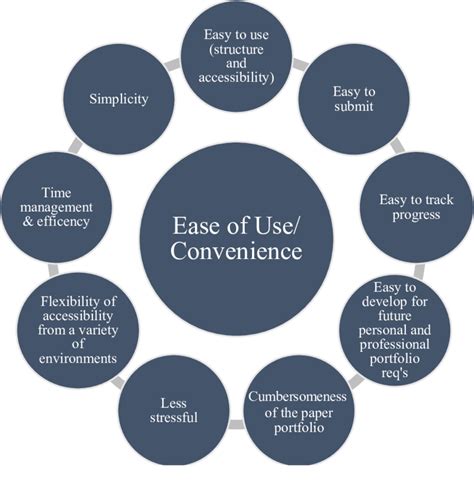

Convenience and Ease of Use

In this section, we will explore the many ways in which a debit card brings convenience and ease of use to everyday financial transactions. From its simplicity and accessibility to its efficiency and adaptability, the convenience offered by a debit card cannot be overstated.

A debit card simplifies the process of making payments, allowing users to make purchases or withdraw cash without the need to carry around large sums of money. With just a swipe or a tap, transactions can be completed swiftly and securely. The ease of use provided by a debit card makes it a preferred choice for many individuals, who can conveniently manage their finances at any time, anywhere.

Moreover, a debit card offers flexibility by providing various features and options. It enables users to link their card to online banking platforms, allowing for seamless management of funds, checking account balances, and reviewing transaction history. Furthermore, the ease of reloading funds onto a debit card, whether through direct deposit or cash deposit, ensures that users can conveniently access their money whenever needed.

The convenience and ease of use provided by a debit card extend beyond simple transactions. It also offers peace of mind and a sense of security. With features like chip technology and personal identification numbers (PINs), users can rest assured that their financial information is protected. Additionally, the ability to freeze or cancel a lost or stolen debit card further enhances the security and convenience it provides.

In conclusion, the convenience and ease of use offered by a debit card make it an essential tool in managing personal finances. Its simplicity, accessibility, flexibility, and security all contribute to a seamless and hassle-free transaction experience, empowering individuals to take control of their financial activities with ease.

Better Budgeting and Financial Discipline

When it comes to managing your finances, one essential aspect is better budgeting and cultivating financial discipline. A strong sense of financial discipline allows individuals to make informed decisions about their spending habits, prioritize their expenses, and save for the future. By utilizing a debit card, individuals can enhance their budgeting skills and develop a greater understanding of their financial responsibilities.

Tracking Expenses: Using a debit card provides a convenient way to monitor and track expenses. With every transaction, individuals receive a detailed record of their spending, including the date, merchant, and amount spent. This level of transparency enables individuals to gain a comprehensive overview of their expenses and identify areas where they can cut back or make adjustments. | Eliminating Debt: Unlike credit cards, which allow individuals to accumulate debt, debit cards provide a means to live within one's means. By using a debit card, individuals can only spend the amount of money they have in their account. This fosters a mindset of responsible spending and eliminates the risk of falling into the cycle of debt. |

Building Saving Habits: A debit card can serve as a valuable tool for building saving habits. By allocating a certain portion of one's income to a designated savings account, individuals can automate the process of saving. With each transaction made using a debit card, a predetermined percentage can be automatically transferred to the savings account. This allows individuals to effortlessly save for their future goals while maintaining their current expenses. | Gaining Control: Using a debit card encourages individuals to take control of their financial situation. It requires a conscious effort to monitor transactions, set spending limits, and make informed choices. This level of control enhances financial discipline and empowers individuals to make decisions that align with their long-term financial goals. |

In conclusion, by incorporating a debit card into one's financial routine, individuals can improve their budgeting skills and develop a greater sense of financial discipline. The transparency and control provided by a debit card enable individuals to track their expenses, avoid debt, build saving habits, and take charge of their financial future.

Enhanced Security and Fraud Protection

When it comes to managing your finances, one of the key concerns is ensuring the safety and security of your hard-earned money. With the ever-increasing advancement in technology, it has become imperative to have robust security measures in place to protect against fraudulent activities.

In this section, we will explore the enhanced security features and fraud protection mechanisms offered by a debit card. These features are designed to provide peace of mind and protect your financial assets from unauthorized access and fraudulent transactions.

One of the primary advantages of using a debit card is the implementation of secure authentication processes. These authentication methods, such as PIN codes or biometric verification, add an additional layer of security to ensure that only authorized individuals can access and use the card.

Furthermore, debit cards often come with advanced encryption technology that safeguards your card information during online transactions. This encryption makes it extremely difficult for hackers or cybercriminals to intercept and misuse your payment details, providing enhanced protection against fraud.

In the unfortunate event of a stolen or lost card, most debit card issuers offer swift action and prompt assistance to prevent any unauthorized transactions. They have dedicated fraud prevention teams that monitor suspicious activities and proactively take measures to prevent fraud, such as blocking the card or notifying you of any unusual transactions.

In conclusion, a debit card offers enhanced security and fraud protection through its secure authentication processes, advanced encryption technology, and prompt assistance in case of theft or loss. These features provide you with peace of mind and confidence in managing your finances, allowing you to enjoy the benefits of a debit card without worrying about unauthorized access or fraudulent activities.

No Fear of Debt

Introducing the concept of financial security and peace of mind, the "No Fear of Debt" section explores the inherent advantages of using a debit card as a payment method. With a focus on avoiding the burdensome consequences associated with debt, this section sheds light on the efficient and responsible management of personal finances.

- Freedom from the shackles of borrowing

- Avoidance of interest rates

- Only available funds can be spent

- No need to worry about accumulating debt

- Encourages responsible spending habits

- Creates a sense of financial stability

By utilizing a debit card, individuals can confidently make purchases without the concern of indebtedness or the stress of long-term financial obligations. The absence of the need to borrow funds not only helps to preserve financial autonomy but also allows for better control and awareness of one's spending habits. With a debit card, there is no fear of accumulating debt, as individuals can only spend the available funds in their account. This promotes responsible money management and discourages impulsive or excessive spending.

Moreover, the absence of interest rates associated with debit cards eliminates the worry of accumulating additional charges on purchases. Unlike credit cards that often come with high-interest rates, debit card transactions are typically interest-free. This advantage serves as a financial relief, as individuals can budget and plan their expenses without the additional burden of interest payments.

Overall, a debit card establishes a sense of financial stability and security. By utilizing available funds for transactions, individuals can maintain control over their financial well-being while having the freedom to make purchases conveniently and securely. With the "No Fear of Debt" feature, a debit card offers a responsible and efficient payment method, supporting individuals' goals of maintaining a healthy financial lifestyle.

Access to Online Shopping and International Transactions

Unleashing the potential of financial freedom, a debit card opens up a world of opportunities for online shopping and international transactions. With a variety of e-commerce platforms and global marketplaces, individuals are empowered to browse, select, and purchase products and services from the comfort of their own homes. This convenient and seamless process eliminates the need for physical stores and enables users to explore a vast array of options with just a few clicks.

Seamless Online Shopping:

With a debit card, individuals are able to effortlessly access a multitude of online stores and immerse themselves in a virtual shopping experience. From clothing and electronics to home décor and groceries, the online marketplace offers an extensive range of products to cater to every need and desire. The ease of navigating through various websites, comparing prices, reading reviews, and making secure payments enhances the overall shopping experience, enabling individuals to find the best deals and make informed purchasing decisions.

Global Reach:

One of the significant advantages of a debit card is the ability to engage in international transactions. Gone are the days of limited options and local markets. With a debit card, individuals can explore a world of international products and services, expanding their horizons and indulging in unique and exotic offerings. Whether it's purchasing designer clothing from Milan or experiencing authentic cuisine from distant corners of the globe, a debit card opens doors to a global marketplace and facilitates seamless cross-border transactions.

Secure and Convenient:

Ensuring the safety of transactions, debit cards provide a secure platform for online shopping and international transactions. With advanced security features and encryption technology, financial institutions prioritize customer protection, providing peace of mind throughout the purchasing process. Additionally, the convenience of a debit card eliminates the need for carrying excessive cash or exchanging currencies, as transactions can be easily completed with just a swipe or a few taps, saving time and effort.

Embracing the Future:

As technology advances, the world of online shopping and international transactions continues to evolve. With a debit card serving as an essential tool in this digital era, individuals have the opportunity to access a wide range of products and experiences that would have otherwise been limited. Embracing the convenience, security, and endless possibilities, the future of shopping lies at the fingertips of those with a debit card, allowing dreams to become a reality.

Rewards and Cashback Programs

When it comes to managing your finances and making the most out of your spending, it's important to consider the potential benefits that rewards and cashback programs offered by debit cards can provide. These programs allow you to earn rewards and receive cashback on your purchases, making it a valuable addition to your financial arsenal.

One of the key advantages of participating in rewards and cashback programs is the ability to earn rewards simply by using your debit card for everyday purchases. Whether it's groceries, dining out, or shopping for essentials, every transaction can contribute to accumulating rewards points or earning cashback. This presents an opportunity to offset your expenses or indulge in additional perks based on your spending habits and preferences.

Furthermore, these programs often offer a variety of redemption options, allowing you to choose how you want to utilize your rewards. Whether it's receiving discounts on future purchases, exchanging points for gift cards to your favorite retailers, or even redeeming them for travel benefits such as airline miles or hotel stays, the flexibility of rewards programs ensures that there is something for everyone.

In addition to earning rewards, cashback programs provide a direct financial benefit by offering a percentage of your purchase amount back to you. This means that every time you use your debit card, you have the opportunity to receive a portion of your money back, which can be particularly advantageous for frequent or high-value purchases.

It's important to note that rewards and cashback programs vary between different debit card providers, so it's essential to compare and choose a card that aligns with your specific financial goals and lifestyle. Whether you're interested in accumulating points for travel benefits or maximizing your cashback opportunities, taking the time to research and select the right debit card can help you make the most out of these programs.

| Rewards and Cashback Programs Summary |

|---|

| - Earn rewards and cashback on everyday purchases |

| - Choose from a variety of redemption options |

| - Receive a direct financial benefit through cashback |

| - Select a debit card that aligns with your goals and lifestyle |

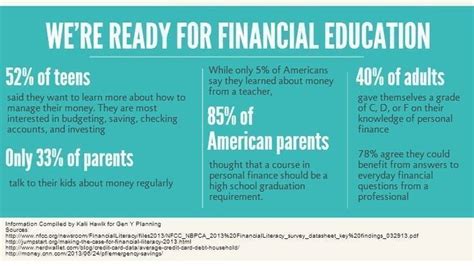

Financial Freedom for Adolescents and Young Adults

Today's youth are increasingly seeking ways to achieve financial independence and establish themselves as self-sufficient individuals. This section explores the various advantages and opportunities that a debit card can provide to adolescents and young adults, giving them the necessary tools to manage their finances responsibly.

1. Empowering Financial Decision-Making

- Teens and young adults can take control of their own money by using a debit card, which allows them to make independent purchasing decisions.

- A debit card promotes financial responsibility as it forces individuals to only spend the money they have, avoiding the accumulation of debt.

- By having access to their own debit card, young individuals can learn to differentiate between wants and needs, making them more conscious of their spending habits.

2. Developing Money Management Skills

- Using a debit card provides a practical opportunity for adolescents and young adults to learn valuable money management skills.

- Young individuals can track their expenditures easily by monitoring their debit card transactions, helping them to budget and plan for future expenses.

- Through the use of debit cards, teens and young adults can gain financial independence and begin to develop long-term saving habits.

3. Building a Credit History

- Using a debit card responsibly can contribute to building a positive credit history for adolescents and young adults.

- Having a good credit history is essential for future financial endeavors, such as applying for loans, renting an apartment, or even starting a business.

- A debit card serves as a stepping stone towards establishing creditworthiness, demonstrating responsible financial behavior to potential lenders and financial institutions.

4. Promoting Security and Convenience

- Debit cards offer a secure method of making transactions, reducing the need to carry large amounts of cash or worry about theft.

- Young individuals can easily access their funds through ATMs and make purchases both online and in-store with their debit cards.

- Debit cards often provide fraud protection, ensuring that unauthorized transactions are promptly addressed and resolved.

By understanding the benefits of a debit card, teenagers and young adults can lay the groundwork for financial independence, responsible money management, and a secure financial future.

Building Credit History and Improving Credit Score

In the realm of personal finance, it is essential to understand the significance of establishing and maintaining a strong credit history. By carefully managing your financial transactions and obligations, you can enhance your creditworthiness and increase your credit score. Building credit history and improving credit score represent crucial steps towards achieving long-term financial stability and fulfilling your aspirations.

Credit history reflects an individual's past borrowing and repayment activities, providing a comprehensive record of their ability to manage debt responsibly. A positive credit history demonstrates reliability in meeting financial obligations and helps financial institutions assess an applicant's creditworthiness. Lenders primarily utilize credit history to determine the terms and conditions of loans, credit cards, and other financial products.

Credit score is a numerical representation of an individual's creditworthiness, providing a quick assessment of their financial stability. It is calculated based on various factors, including payment history, credit utilization ratio, length of credit history, credit mix, and recent credit inquiries. A higher credit score opens doors to better interest rates, favorable loan terms, and increased likelihood of obtaining credit approvals.

Utilizing a debit card can play a crucial role in building credit history and improving credit score, despite not directly contributing to the credit reporting system. By responsibly managing your expenses and ensuring timely payments, you develop fundamental financial habits that are transferable to credit card usage. This practice strengthens your financial discipline and helps establish a positive reputation with financial institutions.

Furthermore, using a secured credit card allows individuals with limited or no credit history to gradually build their creditworthiness. With a secured credit card, a cash deposit is made as collateral, acting as a security measure for the lender. By making timely payments and maintaining a low credit utilization ratio, individuals can demonstrate their creditworthiness and potentially upgrade to traditional unsecured credit cards.

Another effective way to build credit history is by becoming an authorized user on someone else's credit card. This allows you to benefit from their established credit history and positive payment behavior. However, it is crucial to choose the right person to become an authorized user, as any negative activity on their part can impact your credit score negatively.

In conclusion, building credit history and improving credit score are integral steps towards securing a strong financial foundation. By responsibly managing your finances, utilizing debit cards wisely, exploring secured credit cards, and potentially becoming an authorized user, you can take control of your creditworthiness and achieve your long-term financial goals.

FAQ

What is a debit card?

A debit card is a payment card that is linked to the cardholder's bank account. It allows cardholders to make transactions directly from their account, withdrawing the required funds immediately.

What are the benefits of using a debit card?

There are several benefits of using a debit card. Firstly, it provides convenience by eliminating the need to carry cash. Secondly, it allows easy access to funds in the cardholder's bank account. Additionally, debit cards can help to track expenses and budget effectively. Lastly, they offer protection against unauthorized transactions and fraudulent activities.

Can I use a debit card for online shopping?

Yes, you can use a debit card for online shopping. Debit cards are widely accepted by online retailers and can be used to make secure transactions on various e-commerce websites. However, it is important to ensure that the website is reputable and secure before entering your card details.