Imagine a life of boundless possibilities, where the mere thought of it fills you with excitement and wonder. Picture a world where your desires are fulfilled effortlessly, and abundance flourishes in every aspect of your existence. This is the existence that many aspire to, where prosperity and fulfillment intertwine to create a life of ultimate satisfaction.

In this realm of ideals and dreams, we find ourselves pondering the allure of immense wealth. While the concept of material abundance may differ for each individual, the common thread that binds our aspirations is the indisputable allure of financial prosperity. Yet, why does the notion of holding vast riches captivate our minds, and what drives us to pursue this elusive dream?

At the core of our fascination lies the belief that wealth can unlock a multitude of opportunities and experiences. It symbolizes freedom, providing us with the means to explore our passions, indulge in our desires, and impact the world around us. The allure of holding substantial resources, whether it be money or assets, ignites within us a sense of empowerment and security, fueling our aspirations to reach new heights.

Furthermore, the idea of embracing financial abundance invites us to confront our own limitations and challenge the status quo. It encourages us to expand our horizons and redefine the boundaries of what is possible. By striving for prosperity, we open ourselves up to a world of endless possibilities, where innovation and growth become the driving forces behind our journey.

As we embark on a quest for financial prosperity, it is essential to recognize that our pursuit should not be centered solely on accumulating wealth, but rather on the transformation it can bring to our lives and the lives of others. By harnessing our wealth responsibly and with a higher purpose in mind, we can turn our dreams of abundance into a reality that extends far beyond material possessions.

The Psychology of Wealth: Exploring Our Desires and Goals

Understanding the complex interplay between our psychological makeup and our aspirations for financial success can provide valuable insights into the nature of our desires and the goals we set for ourselves. Delving into the psychology of wealth allows us to explore the intricate workings of the human mind when it comes to our longings for prosperity and abundance.

Intrinsic Motivation One key aspect to consider is the role of intrinsic motivation in our pursuit of wealth. Intrinsic motivations stem from personal values, interests, and internal satisfaction. When it comes to financial success, understanding what truly drives us deep within can unlock a clearer understanding of our desires and goals. Exploring the psychological factors that underpin our motivations can shed light on the reasons we aspire to hold vast wealth. |

External Influences Our desires for financial abundance are not solely shaped by internal factors but also by external influences. Society, culture, and the media play a powerful role in shaping our perceptions and desires related to wealth. Consideration of these external influences is essential when examining our psychological relationship with money, as they can significantly impact our attitudes and beliefs about wealth and affect the goals we set for ourselves. |

Emotional Factors Emotions also play a significant role in our desires for wealth. Our psychological response to financial success can be influenced by various emotions such as security, freedom, validation, and even a sense of self-worth. Exploring these emotional factors can deepen our understanding of our motivations for seeking abundant wealth, as well as highlight the potential psychological consequences that may arise from pursuing these aspirations. |

Dreams and Aspirations Examining our dreams and aspirations can provide further insights into the psychology of wealth. Our desires for financial abundance may be driven by a multitude of factors, including personal achievements, social status, or the desire to make a positive impact on the world. Understanding these dreams and aspirations can give us a more comprehensive picture of the underlying psychological forces that shape our relationship with money and drive us towards our goals. |

By delving into the intricacies of the human psyche and exploring the motivations, influences, and emotions that underpin our desires for wealth, we can gain a deeper understanding of ourselves and our aspirations. This knowledge can provide valuable insights as we navigate the pursuit of financial success and abundance.

Transforming Your Wealth Mindset: Overcoming Limiting Beliefs

Within the realm of manifesting financial prosperity, one key aspect to consider is how our mindset influences our relationship with money. The beliefs we hold about abundance or lack can significantly impact our ability to attract and hold onto wealth. In this section, we will delve into the process of breaking free from limiting beliefs that may be hindering your financial growth.

1. Acknowledge Your Current Beliefs:

- Identify the limiting beliefs you currently hold about money, wealth, and abundance.

- Recognize the patterns or negative thoughts that arise when it comes to your financial aspirations.

- Consider how these beliefs have influenced your financial decisions and actions in the past.

2. Challenge and Reframe:

- Question the validity of your limiting beliefs and challenge their accuracy.

- Seek evidence and examples that contradict these beliefs.

- Replace negative thoughts with positive affirmations and empowering statements about money.

3. Embrace a Growth Mindset:

- Develop a mindset that believes in the potential for financial growth and abundance.

- Adopt a willingness to learn, adapt, and take calculated risks in your financial endeavors.

- Cultivate resilience in the face of setbacks and view them as opportunities for growth.

4. Surround Yourself with Positive Influences:

- Seek out mentors, coaches, or individuals with a healthy wealth mindset.

- Join communities or groups focused on personal and financial growth.

- Engage in conversations and surround yourself with individuals who inspire and uplift you in the realm of wealth.

5. Take Action and Track Progress:

- Set realistic financial goals and devise a clear plan of action.

- Implement steps towards achieving your goals and consistently reassess your progress.

- Celebrate small milestones and track your achievements to reinforce positive beliefs and motivation.

By actively addressing and overcoming your limiting beliefs, you can open up new opportunities for wealth creation and abundance in your life. Remember, transforming your money mindset is a continual process, but with persistence and a positive outlook, you can break free from the constraints of limiting beliefs and achieve financial success.

Transforming Scarcity into an Abundance Mindset: Harnessing the Power of Positive Thinking

Shifting our mindset from scarcity to abundance is a powerful tool in achieving success and happiness. By embracing the concept of abundance, we can tap into our own potential and attract positive opportunities, nurturing a mindset of optimism and growth.

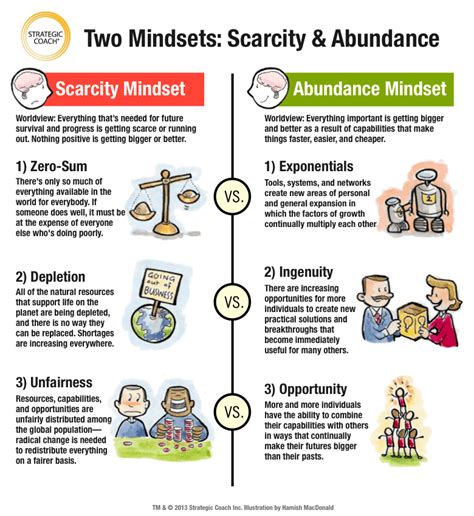

When we view the world through a lens of scarcity, we focus on what is lacking in our lives, be it financial resources, opportunities, or personal fulfillment. This limited perspective creates a mindset of fear and limitation, which in turn hinders our ability to pursue our dreams and goals. However, by consciously adopting an abundance mindset, we can reframe our thoughts and beliefs, opening ourselves up to a world of possibilities and abundance.

An abundance mindset is not just about financial wealth, but also encompasses a broader understanding of abundance in all areas of life. It involves cultivating gratitude for what we already have, acknowledging and celebrating our strengths and talents, and embracing the belief that there is more than enough to go around for everyone.

Positive thinking is a key component of harnessing the power of abundance. By focusing on positive thoughts and beliefs, we can attract and manifest abundance in our lives. This does not mean ignoring or denying the challenges and hardships that may arise, but rather choosing to approach them with a mindset of resilience and growth. By maintaining a positive outlook, we can overcome obstacles, learn from our experiences, and continually propel ourselves forward.

Practicing gratitude is another powerful tool in cultivating an abundance mindset. By appreciating and acknowledging the blessings, big and small, in our lives, we shift our focus from what we lack to what we already have. This shift in perspective opens us up to abundance, as we recognize the abundance that already exists within us and around us.

In conclusion, adopting an abundance mindset through the power of positive thinking is a transformative way to shift from scarcity to abundance. By deliberately choosing to cultivate positive thoughts, embracing gratitude, and focusing on abundance in all areas of our lives, we can unlock our full potential and attract an abundance of opportunities and success.

Strategies for Generating Wealth: Unleashing Financial Triumph

In this section, we will explore a range of tactics and approaches that can propel individuals towards achieving financial success. By implementing these innovative methods, one can effectively pave the way to desirable financial outcomes, ushering in a new era of prosperity.

1. Uncovering Lucrative Opportunities: Embarking on a journey towards financial success often involves identifying and capitalizing on lucrative avenues. By staying attuned to emerging trends and developing a keen eye for spotting promising prospects, individuals can unlock hidden opportunities that lead to astronomical financial gains.

2. Diversifying Income Streams: Relying solely on a single source of income can limit one's financial growth potential. To unlock true financial success, it is crucial to expand and diversify income streams. By exploring various avenues such as investments, entrepreneurship, and passive income sources, individuals can create a robust and resilient financial portfolio.

3. Cultivating an Entrepreneurial Mindset: Developing an entrepreneurial mindset is essential in the journey towards financial triumph. It involves embracing calculated risks, being adaptable to changing market dynamics, and constantly seeking innovative solutions. This mindset empowers individuals to seize opportunities, create value, and generate substantial wealth.

4. Embracing Continuous Learning: Knowledge is a powerful asset that can significantly impact financial success. By committing to lifelong learning, individuals can stay ahead of the curve, acquire valuable skills, and expand their intellectual horizons. This constant pursuit of knowledge equips individuals with the tools necessary to make informed financial decisions and uncover new avenues for wealth creation.

5. Cultivating Financial Discipline: Building wealth requires discipline and prudent financial management. By adopting sound saving and spending habits, individuals can direct their resources towards productive investments and wealth-building activities. Financial discipline also entails managing debt effectively, setting realistic financial goals, and making informed decisions based on careful evaluation.

7. Leveraging Technology: Technological advancements have revolutionized the financial landscape, providing individuals with unprecedented opportunities to unlock financial success. By harnessing the power of automation, digital platforms, and data analysis tools, individuals can optimize financial processes, identify market trends, and make strategic decisions that pave the way to substantial financial returns.

8. Forming Strategic Partnerships: Collaboration is a key driver of financial achievement. By building meaningful relationships and strategic partnerships, individuals can tap into new markets, access valuable resources, and multiply their financial potential. The power of networking and establishing mutually beneficial connections cannot be underestimated in the pursuit of financial success.

9. Nurturing a Positive Money Mindset: In the journey towards financial triumph, fostering a positive money mindset is paramount. This involves developing a healthy relationship with money, embracing abundance, and reframing limiting beliefs surrounding wealth. By cultivating a positive money mindset, individuals open doors to unlimited financial possibilities and invite prosperity into their lives.

By adopting these money-making strategies and combining them with determination, perseverance, and adaptability, individuals can unlock the path to financial success and fulfill their aspirations for wealth creation.

Investing for Prosperity: Building Wealth for the Future

Creating a secure financial future requires much more than simple dreaming or accumulating a large amount of money. It necessitates careful planning, strategic decision-making, and a focus on long-term growth. In this section, we will explore the concept of investing as a means to build prosperity and accumulate wealth over time.

Investing is a process that involves allocating funds with the goal of generating returns that surpass the initial capital. It is a forward-thinking approach that seeks to proactively cultivate financial growth and stability. By strategically investing, individuals have the opportunity to build substantial wealth and ensure a comfortable future. This section will delve into various investment options and strategies that can aid in the pursuit of prosperity.

Stock Market Investment One of the most common forms of investment is the stock market. Purchasing shares of publicly traded companies allows individuals to become partial owners and potentially benefit from the company's growth and success. This subsection will explore the basics of stock market investment, including how to choose stocks, the importance of diversification, and understanding market trends and fluctuations. |

Real Estate Investment Investing in real estate offers a tangible asset that can appreciate in value over time. This subsection will discuss the different types of real estate investments, such as residential properties, commercial properties, and real estate investment trusts (REITs). It will also cover important considerations like location, rental income potential, and the impact of market conditions on real estate investments. |

Entrepreneurial Ventures For those seeking to build their wealth through business ownership, entrepreneurial ventures can offer lucrative opportunities. This subsection will explore the steps involved in starting a business, the importance of thorough market research and planning, and the potential risks and rewards associated with entrepreneurship. |

Alternative Investments In addition to traditional investment options, there are alternative avenues that can diversify one's portfolio and potentially yield high returns. This subsection will introduce various alternative investments, such as commodities, cryptocurrencies, and venture capital, highlighting the unique characteristics and considerations associated with each. |

Investing Mindset Building wealth for the future requires more than just knowing investment options - it requires adopting the right mindset. This subsection will discuss the importance of patience, discipline, and continuous learning in the world of investing. It will also explore the significance of setting clear financial goals and developing a long-term investment strategy. |

The Significance of Education: Empowering Yourself through Financial Literacy

When it comes to experiencing a prosperous and thriving future, the way we perceive and handle our finances plays a crucial role. In order to achieve financial stability and abundance, it is essential to equip ourselves with the necessary knowledge and skills. Education, especially in the realm of financial literacy, empowers individuals to make informed decisions, navigate the complexities of the economic landscape, and secure a better future for themselves and their loved ones.

Safeguarding your financial well-being:

Developing a solid understanding of financial concepts and principles can provide individuals with the tools needed to protect their financial well-being. By familiarizing themselves with topics such as budgeting, saving, investing, and debt management, individuals can make sound financial decisions, avoid pitfalls, and build a strong foundation for long-term wealth accumulation.

Seizing opportunities and embracing financial independence:

Financial literacy serves as a catalyst for seizing opportunities and achieving financial independence. Armed with knowledge about various investment avenues, saving strategies, and the impact of financial decisions, individuals can confidently navigate the financial landscape, identify opportunities for growth, and proactively plan for the future.

Enhancing decision-making abilities:

One of the key benefits of financial education is the enhancement of decision-making abilities. By comprehending the intricacies of personal finance, individuals are better equipped to evaluate the risks and rewards associated with their financial choices. This allows them to make informed decisions, minimize potential losses, and optimize their financial resources for maximum benefit.

Building resilience and financial security:

Financial education not only equips individuals with the knowledge to manage current assets but also empowers them to plan for unforeseen circumstances and build resilience. By understanding insurance, emergency funds, and risk management strategies, individuals can create a safety net that safeguards their financial security, providing peace of mind and a sense of stability in an uncertain world.

Overcoming financial barriers and achieving dreams:

Financial literacy can serve as a powerful tool to overcome barriers and turn dreams into reality. By arming individuals with the knowledge and skills necessary to break free from the cycle of debt, understand credit utilization, and access financial resources, education opens doors to previously unattainable opportunities, bringing individuals closer to their aspirations and dreams.

In conclusion, education plays a pivotal role in empowering individuals through financial literacy. By gaining a deep understanding of financial concepts and developing crucial skills, individuals can protect their well-being, embrace financial independence, enhance their decision-making abilities, build resilience, and overcome barriers to achieve their dreams of economic abundance.

Navigating Financial Risks: Safeguarding Your Wealth

When it comes to managing your financial resources, it is crucial to be aware of the potential risks that can threaten your wealth. This section aims to provide you with practical advice on how to protect and safeguard your financial assets, ensuring their long-term preservation and growth.

- 1. Diversify Your Investment Portfolio:

- 2. Conduct Thorough Research:

- 3. Build an Emergency Fund:

- 4. Regularly Review and Update Your Insurance Coverage:

- 5. Seek Professional Financial Advice:

One effective strategy to mitigate financial risks is to diversify your investments. By spreading your assets across different investment vehicles such as stocks, bonds, real estate, and commodities, you can reduce the impact of any potential losses in a particular sector or asset class.

Before making any financial decisions, it is essential to conduct thorough research and gather as much information as possible. Stay up-to-date with market trends, economic indicators, and potential risks associated with specific investments. This knowledge will empower you to make informed choices and avoid unnecessary losses.

Creating an emergency fund is an important element of safeguarding your wealth. Set aside a portion of your income in a separate account that can be easily accessed during unexpected financial emergencies, providing you with a safety net and preventing your assets from being depleted.

Insurance plays a vital role in protecting your financial well-being. Evaluate your insurance policies regularly to ensure they adequately cover potential risks such as property damage, health emergencies, disability, or death. Make necessary adjustments and additions to your coverage as circumstances change.

Engaging the services of a qualified financial advisor can provide valuable insights and guidance in navigating financial risks. A professional can help you identify potential pitfalls, devise personalized risk management strategies, and make informed decisions in line with your long-term financial goals.

By adopting these measures, you can navigate financial risks effectively and safeguard the wealth you've worked hard to accumulate. Remember, proactively managing and protecting your financial resources is an essential part of achieving long-term financial stability and prosperity.

Giving Back: Generosity and the Ripple Effect of Wealth

In this section, we delve into the concept of philanthropy and its profound impact on both individuals and society as a whole. It explores the idea of sharing one's wealth and resources for the greater good, and how this act of generosity can create a ripple effect that extends far beyond the initial act.

Generosity, a quality often associated with wealth, holds immense power to bring about positive change in the world. When individuals who have been blessed with affluence choose to give back, their actions can inspire and encourage others to do the same. This ripple effect spreads the spirit of generosity, leading to a cycle of giving that transcends financial boundaries.

One of the key benefits of philanthropy is its ability to address various social issues and bring about long-lasting change. By directing funds towards education, healthcare, poverty alleviation, and sustainable development, philanthropists can initiate projects and programs that directly benefit the less fortunate. They not only provide necessary resources but also empower individuals and communities to uplift themselves and create a better future.

Furthermore, the act of giving back allows individuals to stay grounded and connected to their values. It serves as a reminder of the responsibilities that come with wealth and creates a sense of fulfillment that cannot be achieved through material possessions alone. By actively engaging in philanthropy, individuals are able to align their financial success with their personal beliefs and make a meaningful impact in areas that matter to them.

Additionally, philanthropy encourages collaboration between different entities such as businesses, charities, and government organizations. By partnering together, these diverse stakeholders can pool their resources and expertise to tackle complex social challenges that would be difficult to address alone. This collaborative approach fosters innovation, efficiency, and a greater collective impact.

In conclusion, the act of giving back represents a fundamental aspect of wealth that goes beyond individual dreams of abundance. By cultivating a culture of generosity and harnessing the power of philanthropy, individuals can create a ripple effect of positive change, fostering a society that celebrates shared prosperity and works towards a more equitable future.

| Benefits of Giving Back: |

|---|

| - Inspiring others to give |

| - Addressing social issues |

| - Staying connected to values |

| - Fostering collaboration |

Wealth and Happiness: Dispelling the Myth of Money's Impact on Well-being

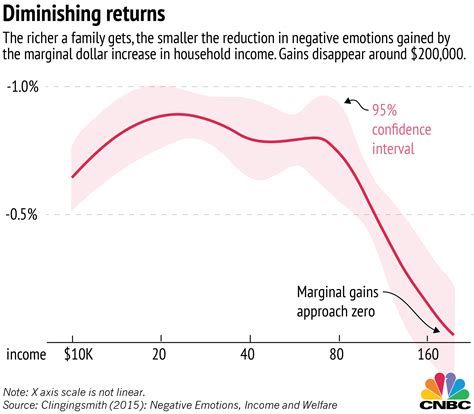

Contrary to popular belief, the relationship between wealth and happiness is not as straightforward as it seems. While it is often assumed that having more money leads to greater well-being, research suggests that this correlation is not as strong as commonly thought.

One of the key misconceptions surrounding wealth and happiness is the belief that having an abundance of money automatically equates to a higher level of well-being. However, numerous studies have shown that once a person's basic needs are met, the happiness derived from additional wealth diminishes significantly.

It is important to acknowledge that money can provide a sense of security and relieve financial stress, which can indirectly contribute to overall well-being. However, this does not necessarily translate into guaranteed happiness. The pursuit of material wealth often comes at the expense of other aspects of life that are essential for true fulfillment, such as meaningful relationships, personal growth, and a sense of purpose.

- Research has found that individuals who prioritize money and material possessions tend to have lower levels of well-being, experiencing higher levels of stress, anxiety, and dissatisfaction.

- In contrast, those who prioritize non-materialistic values, such as personal growth, self-acceptance, and meaningful relationships, tend to report higher levels of well-being and life satisfaction.

- Studies have also shown that individuals who engage in acts of generosity and giving, rather than solely focusing on accumulating wealth for personal gain, experience greater levels of happiness and fulfillment.

Furthermore, the pursuit of wealth often leads to a never-ending cycle of desires and aspirations for more, as the initial accumulation of money fails to provide lasting happiness. This constant striving for more can lead to stress, discontentment, and a diminished sense of well-being.

In conclusion, while money can certainly contribute to certain aspects of well-being, it is crucial to recognize that true happiness is not solely dependent on financial wealth. Prioritizing non-materialistic values, cultivating meaningful relationships, and finding fulfillment in personal growth and purpose are essential for a truly abundant and fulfilling life.

FAQ

Can having a lot of money really make someone happy?

While having a lot of money can provide comfort and security, it does not guarantee happiness. Studies have shown that material wealth alone does not contribute significantly to long-term happiness. Other factors such as relationships, personal fulfillment, and a sense of purpose play a more crucial role in overall happiness.

What are some common misconceptions about holding lots of money?

One common misconception is that having a lot of money automatically solves all problems and brings eternal happiness. In reality, financial abundance may lead to new challenges and responsibilities. Another misconception is that wealthy individuals are always selfish and greedy. However, many wealthy individuals also engage in philanthropy and give back to their communities.

Are there any downsides to holding a significant amount of money?

While there are certainly advantages to having a significant amount of money, there can also be downsides. The pressure and stress that come with managing wealth can be overwhelming. It may also lead to strained relationships with friends and family who may view the individual differently due to their financial status.

What are some strategies for managing and investing large sums of money?

Managing and investing large sums of money require careful planning and guidance. Seeking advice from financial experts, diversifying investments, and creating a solid financial plan can help maximize the benefits of holding a significant amount of money. Additionally, practicing responsible spending and saving habits is crucial to ensure long-term financial stability.

Can a person's mindset towards money make a difference in their financial abundance?

A person's mindset towards money can indeed make a difference in their financial abundance. Having a positive mindset, believing in abundance rather than scarcity, and being open to opportunities can attract wealth. However, it is important to note that mindset alone is not enough and must be paired with strategic actions and financial knowledge.