Indulging in fantasies of a prosperous future is a common human inclination. We all dream of attaining financial stability, but how can we transform these dreams into reality? The answer lies in the simple act of saving. By cultivating a habit of frugality, we can embark on a journey towards achieving our financial goals and experiencing the security and freedom that come with it.

In today's fast-paced world, saving money has become a vital skill that empowers individuals to take charge of their future. However, it is important to understand that saving is not synonymous with deprivation. Rather, it signifies a conscious effort to prioritize our long-term aspirations over short-lived gratification.

The process of saving money necessitates discipline, commitment, and resourcefulness. It involves making informed choices, flexing our financial muscles, and embracing a mindset that values delayed gratification. By distinguishing between needs and wants, we gain the ability to consciously allocate our resources, ensuring that every penny contributes to our financial well-being.

Embracing a frugal lifestyle does not mean sacrificing happiness or fulfillment. On the contrary, it allows us to uncover alternative pathways to joy and satisfaction. It encourages us to explore the myriad of inexpensive or free experiences that life has to offer. With a discerning eye and an open mind, we can find beauty and contentment in the simple pleasures, reducing our reliance on material possessions.

So, take the first step towards financial liberation today. Start saving with intent, armed with the knowledge that each dollar deposited is a testament to your determination and commitment. Let your dreams of a stable and secure future drive you towards achieving your financial goals. Remember, it's never too late to embark on this transformative journey!

Take Action Today and Achieve Financial Success

It's time to seize control of your financial future and start saving money. By making a commitment to saving today, you can pave the way for a secure and prosperous future. Setting specific goals and developing a solid savings plan are key steps in achieving financial success.

When you decide to take charge of your finances, you are embarking on a journey towards financial freedom. By prioritizing saving and making wise financial choices, you can build a strong foundation for your future. This means making conscious decisions about how you spend your money, evaluating your financial habits, and being proactive about saving and investing.

To begin your journey towards financial success, it's important to establish clear goals. By setting specific and achievable objectives, you can stay focused and motivated on your mission to save money. Whether it's saving for a down payment on a house, paying off debt, or building an emergency fund, your goals will serve as a roadmap to guide your financial decisions.

Creating a budget is a crucial step in achieving your financial goals. By tracking your income and expenses, you can identify areas where you can cut back and save more. Consider creating different categories for your expenses, such as necessities, wants, and savings. This will help you prioritize your spending and ensure that you are consistently putting money towards your savings goals.

While saving money requires discipline and sacrifice, it's important to remember that it's not about depriving yourself of everything you enjoy. Instead, think of it as making conscious choices that align with your long-term financial goals. By being mindful of your spending and finding creative ways to save, you can still enjoy a fulfilling life while working towards your financial aspirations.

So, start today! Take the first step towards achieving your financial goals by making a commitment to save money. By developing a plan, setting goals, and making informed financial decisions, you can take control of your finances and pave the way for a brighter future.

Set Clear Financial Goals to Stay Focused and Motivated

Establishing well-defined financial objectives is essential for maintaining a sense of direction and keeping your motivation levels high. By creating clear goals, you provide yourself with a roadmap for success and an actionable plan to make your dreams a reality.

When setting financial goals, it's important to be specific and concrete. Avoid vague statements like "I want to save money" and replace them with targeted aspirations such as "I aim to save $10,000 for a down payment on a house in the next two years." These precise goals provide clarity and enable you to measure your progress effectively.

- Track Your Expenses: To establish clear financial goals, it's crucial to understand where your money is going. Start by tracking your expenses for a month or two, categorizing them into different spending areas. This exercise will help you identify areas where you can cut back and ultimately save more.

- Set Realistic Timelines: Consider the time it will take to achieve your financial objectives. Be realistic about how long it will take to reach each milestone and adjust your timeline accordingly. Avoid setting unrealistic goals that may lead to discouragement and frustration.

- Break Down Your Goals: Large financial goals can often feel overwhelming. Break them down into smaller, more manageable targets. This approach not only makes the overall goal seem less daunting but also allows you to celebrate milestones along the way, providing you with additional motivation to keep going.

- Formulate an Action Plan: Once you have established your clear financial goals, develop an action plan to achieve them. Identify specific steps you need to take and create a timeline for each task. This detailed plan will help you stay focused and accountable for your progress.

- Regularly Assess and Adjust: As you work towards your financial goals, regularly assess your progress. Are you on track? Do you need to make any adjustments to your strategy? By regularly reviewing and adapting your plan, you ensure that it remains relevant and aligned with your changing circumstances.

Setting clear financial goals is an essential step on your journey towards financial success. By establishing specific objectives, tracking your progress, and making necessary adjustments, you can stay focused, motivated, and ultimately achieve the financial stability and freedom you desire.

Create an Attainable Budget Plan for Effective Savings

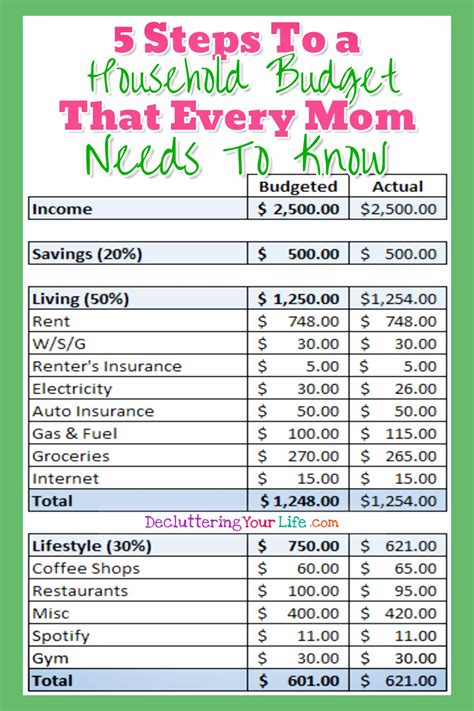

Successful financial management starts with a well-crafted budget plan that allows you to save money effectively. Developing a realistic approach to budgeting is key to reaching your financial goals and achieving stability without unnecessary hardships.

Assess Your Income: Begin by thoroughly evaluating your sources of income, including salaries, investments, and additional revenue streams. Understanding your income streams will help you establish a solid foundation for your budget plan.

Track Your Expenses: Next, it is essential to track your expenses meticulously. Monitor your spending habits to identify areas of potential savings. Categorize your expenses into fixed costs (rent, utilities) and variable costs (entertainment, dining out) to gain a clear understanding of where your money is going.

Set Realistic Saving Goals: Determine how much you can realistically save each month. Consider your income, expenses, and long-term financial aspirations when setting your saving targets. Start by saving a small percentage of your income and gradually increase it as your financial stability improves.

Create a Realistic Budget: Based on your income, expenses, and saving goals, craft a budget that is both flexible and achievable. Allocate funds for essential expenses, such as housing and transportation, while also allowing room for leisure activities and unexpected costs. Use budgeting tools or apps to help you stay organized and track your progress.

Implement Cost-Cutting Measures: Look for areas in which you can reduce expenses without sacrificing your quality of life. Explore options such as negotiating bills, cutting unnecessary subscriptions, or opting for cost-effective alternatives. Small adjustments can make a significant difference in your overall savings.

Regularly Review and Adjust: Periodically reviewing your budget is crucial to ensure it remains relevant and effective. Evaluate any changes in your financial situation and adjust your budget accordingly. This ongoing assessment will help you maintain control over your finances and continue making progress towards your savings goals.

In conclusion, creating a realistic and attainable budget plan is an essential step towards effective money saving. By assessing your income, tracking expenses, setting achievable saving goals, and regularly reviewing your budget, you can take control of your finances and work towards a more secure financial future.

Harness the Power of Compound Interest to Boost Your Savings

Unlocking the full potential of your savings may seem like an elusive dream, but there is a powerful tool at your disposal that can help you achieve your financial goals. It's called compound interest, and by understanding how it works and implementing it wisely, you can supercharge your savings and watch your money grow exponentially over time.

Compound interest is the accumulation of interest on both the initial principal amount and the interest that has been previously earned. Unlike simple interest, where you earn interest only on the initial principal, compound interest allows your savings to grow at an accelerated rate. This compounding effect can work in your favor by generating more interest over time, helping your savings snowball into a substantial amount.

To harness the power of compound interest, it's essential to start saving as early as possible. The longer your money has to accumulate interest, the greater the potential for growth. By making regular contributions to your savings and reinvesting the interest earned, you can take advantage of compounding to maximize your returns.

Another key factor in utilizing compound interest effectively is choosing the right savings vehicle. Investing in instruments that offer compound interest, such as certain types of savings accounts or certificates of deposit (CDs), can amplify the growth potential of your savings. Additionally, considering long-term investments like stocks or mutual funds can further enhance the power of compounding over extended periods.

Consistency is the key to unlocking the full benefits of compound interest. By consistently adding to your savings and letting the interest compound, you can establish a steady and upward trajectory for your financial goals. Remember, even small contributions can make a significant difference over time, thanks to the magic of compound interest.

- Start saving early to harness the power of compounding.

- Choose the right savings vehicles that offer compound interest.

- Consider long-term investments for increased growth potential.

- Be consistent in adding to your savings to maximize the benefits of compound interest.

By taking advantage of the power of compound interest, you can accelerate the achievement of your financial goals and build a solid foundation for your future. Start today and let your savings work for you!

Adopt Thrifty Habits and Reduce Expenditure to Enhance Savings

Embracing a frugal lifestyle and practicing wise spending habits can significantly contribute to achieving your financial goals. By making conscious choices in how you allocate your resources and minimizing unnecessary expenses, you can maximize your savings potential and pave the way for a secure financial future.

| Identify and Prioritize Expenses | Pinpointing your essential and discretionary expenses is the first step towards cutting costs. Categorize your spending habits and evaluate where you can make adjustments to reduce unnecessary outflows. |

|---|---|

| Trim Variable Costs | Identify areas where you can economize and find alternatives to expensive goods and services. Consider opting for generic brands, reducing energy consumption, or exploring discounts and deals when making purchases. |

| Review Subscriptions and Memberships | Assess the value and frequency of your subscriptions and memberships. Consider canceling those that no longer serve your needs and seek more cost-effective options for the ones you decide to keep. |

| Create a Budget | A well-defined budget is a fundamental tool for saving money. Determine your income, allocate portions to various expense categories, and track your spending to ensure you stay within your financial limits. |

| Practice Mindful Shopping | Adopting a mindful approach to shopping can help you avoid impulsive buying and make more informed purchasing decisions. Before making a purchase, consider its necessity, search for alternatives, and compare prices to get the best deal. |

| Embrace DIY Mentality | By learning to do certain tasks or repairs yourself, you can save significant amounts in labor costs and gain a sense of accomplishment. Explore DIY tutorials or seek out guidance from experts to develop new skills that can help you cut expenses. |

| Maximize Savings on Utilities | Implementing energy-efficient practices at home, such as using LED light bulbs, adjusting thermostat settings, and properly insulating your living space, can lead to substantial savings on utility bills. |

| Plan Meals and Minimize Food Waste | Meal planning and reducing food waste not only contribute to a healthier lifestyle but can also save you money. Plan your meals, make a shopping list, and avoid purchasing excess perishable items that may go to waste. |

| Find Low-cost Entertainment Alternatives | Entertainment doesn't have to break the bank. Look for free or low-cost options such as community events, outdoor activities, or exploring local parks and attractions to enjoy leisure time without compromising your financial goals. |

By integrating these frugal habits into your daily life, you can manage your expenses more efficiently and make significant strides towards achieving your financial aspirations.

FAQ

What are some effective ways to save money?

There are several effective ways to save money. One tried and tested method is to create a budget and stick to it. By tracking your income and expenses, you can identify areas where you can cut back and save. Another way is to automate your savings by setting up automatic transfers from your checking account to a savings account. Additionally, you can save money by reducing unnecessary expenses such as eating out less, canceling unused subscriptions, and shopping for deals and discounts.

Why is it important to have financial goals?

Having financial goals is important because they provide direction and motivation for your financial decisions. They help you prioritize your spending and saving, ensuring that your money is being used wisely. Financial goals also give you a sense of accomplishment when you achieve them and can provide security and peace of mind for the future. Whether your financial goal is to save for a down payment on a house, pay off debt, or travel the world, having a clear goal can help you stay focused and committed.

How can I save money when I have a low income?

Saving money on a low income may seem challenging, but it is definitely possible. Start by cutting unnecessary expenses and finding ways to reduce your fixed costs. This could involve downsizing your living arrangements, negotiating lower insurance rates, or finding cheaper alternatives for everyday items. It's also essential to prioritize your savings, no matter how small the amount. Even saving a few dollars each week can add up over time. Lastly, consider finding ways to increase your income, such as taking on a part-time job or freelancing.

How do I stay motivated to save money?

Staying motivated to save money can be a struggle, but there are strategies that can help. First, it's important to set clear and achievable goals that are meaningful to you. Visualize the benefits of reaching your goals and remind yourself of them regularly. Another technique is to reward yourself along the way. For example, after reaching a savings milestone, treat yourself to something small or do something you enjoy. Additionally, find an accountability partner or join a community of like-minded savers to share tips, challenges, and successes.

What are the long-term benefits of saving money?

Saving money has numerous long-term benefits. Firstly, it provides financial security and a safety net in case of emergencies. It also enables you to achieve your long-term financial goals, such as buying a house, starting a business, or retiring comfortably. Saving money can also help reduce stress and provide peace of mind, knowing that you have financial stability. Moreover, having savings allows you to take advantage of investment opportunities and grow your wealth over time. Overall, saving money sets the foundation for a more secure and financially independent future.