We all have a longing for boundless riches, a desire to bask in the opulence that life can offer. The yearning to unlock the doors to prosperity and attract an abundance of material wealth is an innate human impulse that drives us to explore various methods and practices.

Within the realm of achieving financial success, finding alternative pathways to generate and accumulate substantial resources becomes imperative. It is not solely about acquiring vast amounts of currency, but also about cultivating a mindset, a set of beliefs, and implementing strategies that allow for the flow of prosperity to manifest effortlessly in one's life.

Guiding the universe towards your financial aspirations requires a combination of intention, action, and a profound belief in the power of abundance. By making small but significant changes in your approach, you can effectively transform the trajectory of your financial reality.

Understanding the intricate dynamics of wealth creation and harnessing the inherent energies that surround it are pivotal in the pursuit of attracting immense financial prosperity. This involves recognizing the potential of your own thoughts and emotions in shaping the financial landscape, as well as leveraging the universal laws that govern abundance and affluence.

The Power of Visualization: Manifesting Your Prosperous Future

Imagine a world where your desires become reality, where your dreams transform into tangible wealth. This unique section explores the extraordinary power of visualization and how it can shape your wealthy future. By harnessing the immense potential of your mind, you can manifest abundance and attract prosperity into your life.

Visualization is a practice that involves creating vivid mental images of your desired outcome. Through focused and intentional visualization, you can align your thoughts and emotions with the wealth you aspire to achieve. By immersing yourself in the sensation of already possessing abundance, you send a powerful message to the universe, attracting the necessary resources and opportunities to manifest your financial goals.

- 1. Clarify your financial aspirations: Begin by clearly defining your financial goals. Identify specific milestones and achievements you envision for your prosperous future. This clarity will provide direction for your visualization practice.

- 2. Create a detailed mental image: Close your eyes and imagine yourself in your ideal financial state. Visualize the luxurious lifestyle, the financial freedom, and the opportunities that wealth brings. Engage all your senses as you immerse yourself in this empowering mental image.

- 3. Embrace the emotions of abundance: Feel the exhilaration, joy, and gratitude that arise from envisioning your prosperous future. Allow these positive emotions to permeate every cell of your being, as if you have already achieved your financial goals.

- 4. Visualize daily with unwavering belief: Make visualization a daily ritual. Spend a few minutes each day immersing yourself in your desired financial reality. As you visualize consistently, you strengthen your belief in your ability to attract wealth and open yourself to unlimited possibilities.

- 5. Take inspired action: Visualization alone is not enough; it must be accompanied by inspired action. Use the clarity gained from your visualization practice to set concrete steps toward your financial goals. Take consistent action aligned with your vision, and watch as the universe aligns itself to support your endeavors.

Visualization is a powerful tool that can transform your mindset, attract wealth, and pave the way to a prosperous future. By incorporating visualization into your daily routine and pairing it with inspired action, you empower yourself to manifest the abundant financial reality you've always dreamed of.

Unlocking the Power of Your Subconscious Mind: Utilizing the Law of Attraction

Within the realms of achieving prosperity and manifesting desires, one vital aspect that cannot be overlooked is the incredible potential of the subconscious mind. It plays a significant role in our ability to attract the life we desire, utilizing a powerful force known as the Law of Attraction. In this section, we explore the methods through which we can tap into the hidden depths of our subconscious to unlock our true potential and bring forth a cascade of abundance.

Understanding the Subconscious Mind:

The subconscious mind can be likened to the unseen architect of our reality. It is that deep reservoir of thoughts, beliefs, and emotions that shape our perceptions and drive our actions, often without our conscious awareness. By harnessing the power of the subconscious mind, we gain access to the tools necessary to align our thoughts and emotions with the vibrations of prosperity and abundance.

Activating the Law of Attraction:

The Law of Attraction states that like attracts like; therefore, by aligning our thoughts, emotions, and beliefs with the abundance we desire, we can draw these experiences into our lives. To effectively activate the Law of Attraction, we must first create clear and specific intentions through the power of visualization and affirmation. By visualizing ourselves already in possession of the desired wealth and embracing the associated emotions, we signal to the subconscious that this is our reality.

Reprogramming Limiting Beliefs:

Often, the subconscious is filled with limiting beliefs about money, success, and abundance, acquired from childhood and societal conditioning. To unlock its full potential, it is crucial to identify and reprogram these limiting beliefs. Through techniques such as positive affirmations, hypnosis, or neuro-linguistic programming (NLP), we can replace these negative beliefs with empowering ones that support our financial goals.

Cultivating an Attitude of Gratitude:

Incorporating gratitude into our daily lives is a powerful practice that enhances the effectiveness of the Law of Attraction. By expressing gratitude for the wealth and prosperity we currently possess, and for the abundance we are attracting, we align ourselves with the positive vibrations of the universe, attracting even more to be grateful for. It is through the resonance of gratitude that our subconscious mind becomes a magnet for unlimited wealth.

Unlocking the power of the subconscious mind to harness the Law of Attraction is a fundamental step in the journey towards unlimited wealth. By understanding, activating, and reprogramming our subconscious, and incorporating gratitude into our daily lives, we can open the floodgates to a life filled with abundance and prosperity.

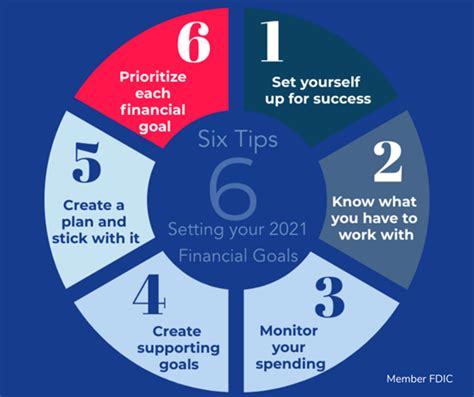

Financial Goal Setting: Creating a Clear Path to Financial Abundance

Setting clear financial goals is essential for attracting wealth and achieving financial abundance. By establishing a roadmap for your financial journey, you can pave the way for success and ensure you're heading in the right direction.

To begin, it's important to define your financial aspirations and desires. What do you hope to achieve in terms of your finances? Are you aiming for a comfortable retirement, financial independence, or the ability to provide for your family's future? By identifying your ultimate financial goals, you can create a clear path towards achieving them.

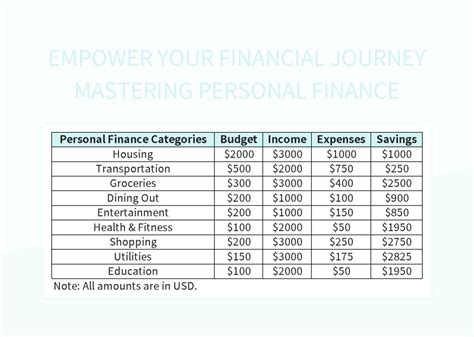

- Develop a Financial Plan: Once you have a grasp of your financial goals, it's crucial to develop a comprehensive plan. Consider factors such as your current income, expenses, debts, and investments. By taking stock of your financial situation, you can identify areas for improvement and develop strategies to maximize your income and minimize expenses.

- Set Specific, Measurable, Attainable, Relevant, and Time-bound (SMART) Goals: When setting financial goals, it's important to ensure they are SMART. This means they should be specific, measurable, attainable, relevant, and time-bound. For example, instead of simply aiming to save money, set a goal to save a specific amount each month for a specific purpose within a designated timeframe.

- Create a Budget: A budget is an invaluable tool for financial goal setting. By tracking your income and expenses, you can gain insight into your cash flow and identify areas where you can make adjustments. A budget will help you allocate funds towards your goals and ensure you're staying on track.

- Establish Milestones: Break down your financial goals into smaller milestones. Achieving these milestones along the way will provide a sense of progress and motivate you to continue moving forward. Celebrate each milestone as a step closer to financial abundance.

- Stay Focused and Flexible: While it's important to remain focused on your financial goals, it's also crucial to be adaptable. Circumstances may change, and it's essential to be open to adjusting your plan as necessary. Stay committed to your goals but be willing to make modifications if needed.

By following these steps and having a clear path towards your financial goals, you create a strong foundation for attracting abundance and achieving lasting financial success. Remember, the journey to financial abundance starts with setting the right goals and taking consistent action towards achieving them.

Mastering the Art of Appreciation: Cultivating a Prosperity Mentality

In this section, we will explore the power of gratitude and its profound impact on developing a mindset of abundance and prosperity. By understanding the art of appreciation and cultivating a sense of gratitude, individuals can tap into the unlimited potential for wealth and success.

The Power of Appreciation

When we express gratitude for the blessings and abundance that already exist in our lives, we shift our focus from scarcity to abundance. By acknowledging and appreciating what we already have, we open ourselves up to receiving even more. In every moment, there are opportunities to find something to be grateful for, whether it is a small act of kindness or a significant achievement.

Cultivating a Prosperity Mentality

Developing a prosperity mentality requires a conscious effort to train our minds to recognize abundance in all aspects of life. By shifting our perspective from lack to sufficiency, we attract greater financial abundance and opportunities. Practicing gratitude is a key component of this process, as it helps us cultivate a mindset focused on abundance, wealth, and success. It allows us to see the potential for growth and prosperity in ourselves and others.

Gratitude as a Daily Practice

To master the art of appreciation, it is essential to make gratitude a daily practice. This can be done through simple acts like keeping a gratitude journal or expressing gratitude towards others. When we make a habit of recognizing and acknowledging the blessings in our lives, we become more aligned with the flow of abundance and attract more financial prosperity.

Attracting Wealth Through Appreciation

By mastering the art of gratitude, we create a positive energy that attracts wealth into our lives. When we appreciate what we have and the opportunities that come our way, we open doors for financial success. This mindset shift allows us to take inspired actions towards our goals and manifest our desires.

In conclusion, developing a prosperity mentality through the practice of gratitude is a powerful tool in attracting wealth and creating an abundance of financial opportunities. By harnessing the power of appreciation and cultivating a mindset focused on abundance, individuals can unlock their true potential for financial success and fulfill their dreams.

Unlocking Your Mind's Potential for Prosperity: Overcoming Limiting Beliefs

Our beliefs have a profound impact on our reality, shaping our thoughts, actions, and ultimately, our level of abundance. In this section, we will delve into the power of rewiring your mind to overcome limiting beliefs and create a mindset of prosperity.

At times, we may find ourselves held back by self-imposed limitations that hinder our ability to attract financial success. These beliefs can manifest as doubts, fears, or feelings of unworthiness, acting as roadblocks on our path to prosperity. By identifying and addressing these limiting beliefs, we can begin to break free from their constraints and open ourselves up to a wealth of opportunities.

One effective method for rewiring the mind is through conscious affirmations and positive self-talk. By regularly repeating empowering statements, we can reprogram our subconscious mind to believe in our inherent worthiness and ability to achieve financial abundance. These affirmations can serve as powerful reminders of our unlimited potential and can help to dissolve any lingering doubts that may be holding us back.

In addition to affirmations, it is crucial to cultivate a mindset of abundance and gratitude. This involves shifting our focus from scarcity and lack to abundance and appreciation. By recognizing and acknowledging the blessings and abundance already present in our lives, we create a positive energy that attracts more of the same. This shift in perspective allows us to tap into the universal flow of abundance and align ourselves with the opportunities and resources necessary for financial success.

Moreover, it is important to surround ourselves with like-minded individuals who support and uplift our financial goals. By engaging in conversations and associations that promote prosperity, we can reinforce our positive beliefs and amplify our ability to attract wealth. Collaborating with others who share our aspirations can provide valuable insights and inspiration, while also creating a supportive environment for personal growth and financial abundance.

Ultimately, rewiring your mind for prosperity requires a commitment to self-reflection, self-belief, and continuous personal development. By challenging and replacing limiting beliefs with empowering ones, cultivating an attitude of gratitude, and fostering meaningful connections with others, you can unlock the unlimited potential within your mind for attracting financial abundance and living a prosperous life.

Taking Inspired Action: Strategies for Harnessing the Power of Wealth

In this section, we will explore effective strategies for leveraging your financial resources to create a life of abundance and fulfillment. By adopting a proactive and inspired approach, you can truly make money work for you.

| Action-Oriented Mindset | Identify Opportunities | Adopting a Growth Mindset |

Cultivate an action-oriented mindset that drives you to convert ideas into tangible results. Believe in yourself and your ability to achieve financial success. | Develop the ability to identify lucrative opportunities that align with your skills, interests, and values. Conduct extensive market research and stay informed. | Embrace a growth mindset that views setbacks as opportunities for learning and improvement. Continually seek ways to expand your knowledge and skills in the pursuit of wealth. |

| Create Multiple Streams of Income | Efficient Resource Allocation | Building a Support Network |

Diversify your income streams by exploring various avenues such as entrepreneurship, investments, and passive income opportunities. This approach enhances financial stability and potential growth. | Strategically allocate your financial resources by prioritizing essential expenses while also investing in income-generating ventures. Optimize your budget to maximize returns and minimize wasteful spending. | Surround yourself with like-minded individuals who share your aspirations for financial success. Build a support network that provides guidance, motivation, and accountability on your wealth creation journey. |

By taking inspired action and implementing these strategies, you can unleash the power of money and leverage it to shape a life of abundance, security, and fulfillment. Remember, wealth is not a destination, but a journey that requires dedication and continuous growth.

FAQ

What is the key to attracting unlimited wealth?

The key to attracting unlimited wealth is to cultivate a mindset of abundance and develop a strong belief in your ability to achieve financial success. It involves aligning your thoughts, emotions, and actions with the intention of attracting wealth into your life.

How can I change my mindset from scarcity to abundance?

Changing your mindset from scarcity to abundance involves practicing gratitude, adopting positive affirmations, and visualizing your desired financial goals. Surrounding yourself with positive influences and avoiding negative environments can also help in shifting your perspective.

Is it possible to attract money without working hard?

While attracting money does require effort, it doesn't necessarily mean you have to work excessively hard or exhaust yourself. It involves finding the right balance between taking inspired action and allowing the universe to work its magic. By focusing on your desires, being open to opportunities, and taking consistent steps towards your financial goals, you can attract money without feeling overwhelmed.

What are some effective techniques for manifesting wealth?

Some effective techniques for manifesting wealth include visualization, setting clear intentions, creating a vision board, practicing daily affirmations, and maintaining a positive attitude. It is important to believe in the abundance that you seek and take consistent action towards your financial goals.

Can anyone attract unlimited wealth, or is it only for a select few?

Unlimited wealth is available to anyone who is willing to put in the effort and adopt the necessary mindset. It is not limited to a select few; rather, it is a result of aligning your thoughts and actions with the belief that you are deserving and capable of achieving financial success. Anyone who is committed and takes consistent steps towards their goals can attract unlimited wealth.