Every individual holds a secret desire to obtain something truly special, an item that will bring joy and satisfaction to their life. Whether it be a luxurious car, an enchanting piece of jewelry, or a cutting-edge gadget, the yearning to possess such treasures resides within us all. This inexplicable urge, fueled by passion and ambition, creates a sense of purpose and motivates us to work towards fulfilling our aspirations.

Embarking on the journey towards acquiring your cherished possession requires a careful balance of determination, patience, and meticulous planning. It is essential to navigate through the maze of choices and make informed decisions that align with your values and preferences. Exploring various options, staying updated with the latest trends, and understanding the market dynamics are crucial steps in paving the path towards materializing your dreams.

Visualize, visualize, visualize. Immerse yourself in the vision of owning the object of your desire. Close your eyes and let your imagination soar, picturing yourself with the item in your possession. Visualizing success not only fuels your determination but also helps manifest your intentions into reality. Embrace the power of positive thinking, believe in the possibility of obtaining your dream, and let this unwavering faith be your guiding light.

Patience, oh virtuous virtue! In a world that often glorifies instant gratification, it is important to recognize that the path to acquiring your dream purchase may not be a swift one. Rome wasn't built in a day, and likewise, your dream purchase may require time, effort, and persistence. Embrace the journey as an opportunity for personal growth and discovery. Cultivate patience as you cross each milestone towards your goal, understanding that delayed gratification can make the eventual triumph all the more exhilarating.

Setting Clear Financial Objectives

When it comes to achieving your desired purchases, one of the key factors is establishing clear financial goals. These goals provide a roadmap and ensure that you stay focused and motivated throughout the process. By setting specific objectives, you can effectively plan and allocate your resources, enabling you to make the necessary financial decisions to bring your aspirations to reality.

One way to approach setting clear financial goals is by outlining the desired outcome or target you want to achieve. This could be purchasing a new home, a car, or even saving for a dream vacation. Defining your objectives with precision allows you to evaluate the necessary financial commitment and gives you a concrete endpoint to work towards.

In addition to identifying the desired outcome, it is essential to consider the timeline within which you want to achieve your goals. This timeline will guide your financial planning and help you determine the steps needed to reach your target within a specific timeframe. By setting realistic deadlines, you can track your progress and make any adjustments if necessary, ensuring that your financial goals remain attainable.

It is also crucial to assess your current financial situation and determine any potential obstacles or limitations that may impact your goal. Understanding your income, expenses, and saving capacity can aid in creating a feasible plan of action. This evaluation allows you to identify any areas where adjustments need to be made to maximize your financial resources and increase your chances of achieving your desired purchase.

| Key Points: |

|

Creating a Feasible Budget

Developing a practical budget is a critical step towards achieving your aspiration of acquiring a desired item. By carefully planning your finances, you can effectively manage your expenses and allocate funds towards fulfilling your purchasing goal.

Firstly, it is important to assess your current financial situation. Analyze your income sources, including your salary, investments, and any additional earnings. This evaluation will provide you with a clear picture of how much money you have available to allocate towards your purchase.

Next, make a list of your regular expenses, such as rent, utilities, groceries, and transportation. Consider both essential and non-essential expenses to understand your current spending habits. Identifying these expenditures will help you determine areas where you can cut back or adjust to accommodate your purchasing goal.

Once you have assessed your income and expenses, set a realistic timeline for achieving your desired purchase. Consider factors such as the cost of the item, your current savings, and how much you can comfortably dedicate towards the purchase each month. This timeline will provide you with a target date, giving you a clear sense of progress as you work towards your goal.

Remember to be flexible and adaptable throughout the budgeting process. Unexpected expenses may arise, or your financial situation may change. Stay focused on your goal and make adjustments as needed to ensure you stay on track towards achieving your dream purchase.

Creating a realistic budget is an essential part of turning your purchase dream into a tangible reality. By carefully managing your finances and prioritizing your spending, you can confidently work towards acquiring the item you desire. Stay committed, adjust when necessary, and soon enough, you will be celebrating the fulfillment of your dream purchase.

Saving Money Effectively

Managing your finances wisely is essential when it comes to realizing your aspirations of owning the items you desire. By adopting effective strategies and making conscious choices, you can make significant progress in saving money while still enjoying your life to the fullest.

Set realistic goals: Establishing clear objectives for your savings will help you stay focused on your long-term aspirations. Whether it's a dream vacation, a new car, or a home upgrade, having a specific target in mind will motivate you to save effectively.

Create a budget: A well-planned budget is a crucial tool in saving money. It enables you to track your expenses and identify areas where you can cut costs. By categorizing your expenses and setting limits for each category, you can allocate a portion of your income towards your savings goals.

Comparison shopping: Before making any purchase, it's essential to research and compare prices from different retailers. Take advantage of online platforms, price comparison websites, as well as discounts and coupons to ensure that you are getting the best deal possible.

Avoid impulse buying: Impulse purchases can hinder your ability to save money effectively. Before making a purchase, take a moment to evaluate whether it aligns with your long-term goals and if it is a necessary expenditure. Delaying gratification and carefully considering each purchase can help you make more informed decisions and avoid unnecessary expenses.

Embrace frugality: Adopting a more frugal lifestyle can significantly impact your savings. Look for ways to cut back on expenses, such as cooking at home instead of eating out, opting for generic brands instead of expensive ones, and finding free or low-cost entertainment options in your community. Small changes in your daily habits can add up to significant savings over time.

Create an emergency fund: Unexpected expenses can quickly derail your savings progress. By setting aside a portion of your income for emergencies, you can avoid accumulating debt and maintain financial stability. An emergency fund provides a safety net that allows you to handle unforeseen circumstances without compromising your long-term financial goals.

Automate your savings: Take advantage of automation tools offered by your bank or financial institutions. By setting up automatic transfers from your checking account to your savings account, you can make saving a habit without having to rely solely on willpower. This removes the temptation to spend before saving, making it easier to reach your financial objectives.

Taking proactive steps to save money effectively enables you to make progress towards fulfilling your dreams of making purchases while also ensuring long-term financial security. By setting realistic goals, creating a budget, being mindful of your spending habits, and making conscious choices, you can make your financial aspirations a reality.

Exploring and Comparing Prices: Crucial Steps in Achieving Your Purchase Goal

When it comes to turning your aspirations into reality and acquiring that desired item, thorough research and effective price comparison play indispensable roles. Armed with knowledge and discretion, you can make informed decisions that align with your budgetary constraints and meet your desired quality standards.

In order to embark on this enlightening journey, the first step is to gather information from a wide array of sources. Utilize the vast resources available at your fingertips by exploring various online platforms, browsing through retailers' websites, and consulting reputable shopping comparison websites. This comprehensive approach allows you to familiarize yourself with different options, comprehend the market landscape, and identify potential discounts or promotional offers.

- Consider utilizing price comparison websites or apps to streamline and simplify your research process. These tools aggregate prices from different sellers and provide detailed comparisons, ensuring you have access to the most up-to-date information.

- Do not limit yourself to online platforms alone. Physical stores can often offer unique advantages, including in-person customer service, hands-on product experience, and the possibility of negotiating prices. Visiting multiple retailers or attending relevant trade shows can provide valuable insights and may even lead to unexpected deals.

- Remember to factor in additional costs such as shipping fees, taxes, or warranties while comparing prices. A seemingly attractive price tag may lose its appeal if accompanied by substantial additional expenses.

- Furthermore, keep an eye out for seasonal sales, promotional periods, or significant events like Black Friday or Cyber Monday when prices are known to significantly drop. Timing your purchase strategically can help stretch your budget further.

Ultimately, conducting thorough research and diligently comparing prices equips you with the knowledge and confidence needed to make an informed purchase. Through this proactive approach, you can strike a balance between your desires and your budget, ensuring a satisfying and fulfilling outcome.

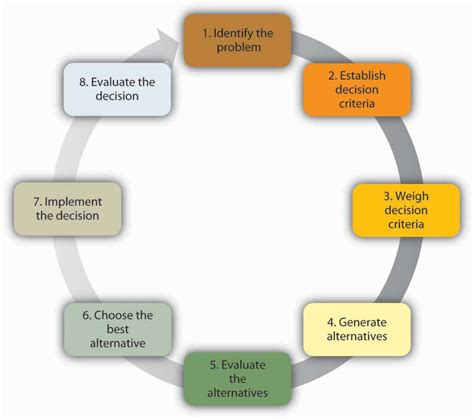

Making Informed and Rational Decisions

When it comes to achieving our aspirations and obtaining desired possessions, it is crucial to approach the decision-making process with careful deliberation and a well-informed mindset. In this section, we will explore the significance of gathering relevant information and employing rational thinking when making purchasing choices.

Educating Yourself: Knowledge is power, and this principle holds true when it comes to making informed decisions. Before making a purchase, it is essential to educate yourself about the product or service you are interested in. This can be done by conducting research, reading reviews, and seeking recommendations from trusted sources. By gaining a comprehensive understanding of the item, its specifications, and its pros and cons, you can make a more well-rounded decision.

Considering Alternatives: Another key aspect of making rational decisions is to consider alternatives. Instead of solely focusing on one particular option, explore different possibilities and evaluate their suitability based on your needs and preferences. By comparing various alternatives, you can ensure that your decision is not based on impulse or limited information, but rather on a sound comparison that takes into account different factors.

Evaluating Long-Term Impact: Making an informed decision involves considering the long-term impact of your purchase. This includes factors such as the durability, sustainability, and overall value of the product or service. By evaluating the long-term implications, you can ensure that your decision aligns with your goals and values, and that it will continue to bring you satisfaction and utility in the future.

Assessing Costs and Benefits: Taking into account the costs and benefits associated with your desired purchase is an integral part of rational decision-making. Analyze the financial implications, including the price, maintenance costs, and potential resale value. Additionally, consider the non-financial benefits, such as the enjoyment, convenience, or improvement the item may bring to your life. Balancing these factors will help you make a decision that aligns with both your budget and your overall satisfaction.

Seeking Advice and Opinions: Lastly, seeking advice and opinions from others can provide valuable insights when making a purchase. Engaging in discussions, consulting experts, or reaching out to individuals who have prior experience with the product or service can provide you with perspectives and considerations you may have overlooked. Additionally, it can help you gain confidence in your decision-making process and feel more secure in your choice.

In conclusion, making informed and rational decisions when it comes to purchasing requires a comprehensive approach that involves educating yourself, considering alternatives, evaluating long-term impact, assessing costs and benefits, and seeking advice. By following these principles, you can ensure that your choices align with your aspirations and contribute to your overall satisfaction.

FAQ

What are some tips for saving money to fulfill my dream of making a purchase?

There are several tips you can follow to save money for your dream purchase. Firstly, create a budget and prioritize your expenses. Cut down on unnecessary spending and stick to your budget religiously. Additionally, consider setting up an automatic savings plan where a fixed amount is transferred to your savings account every month. This way, you won't even notice the money leaving your account. Lastly, look for ways to increase your income, such as taking on a side gig or freelance work.

Is it better to purchase the item of my dreams in cash or with a credit card?

Purchasing the item of your dreams in cash is usually the better option. When you pay with cash, you avoid accumulating debt and paying interest charges. It also helps you stay within your budget and forces you to save in advance. However, if you don't have enough cash on hand, using a credit card can be an option. Just make sure to choose a credit card with good rewards and a low interest rate. Pay off the balance as soon as possible to avoid any unnecessary charges.

How can I stay motivated to save for my dream purchase?

Staying motivated to save for your dream purchase can be challenging, but there are techniques that can help. Firstly, visualize your goal and remind yourself of it constantly. You can create a vision board or set a picture of the desired item as your phone wallpaper. Breaking down your goal into smaller milestones and rewarding yourself when you reach them can also provide motivation. Additionally, surround yourself with like-minded individuals who share similar financial goals, as they can offer support and encouragement.

What are some alternatives to making a big purchase without breaking the bank?

If making a big purchase seems financially overwhelming, there are alternatives you can consider. One option is to look for used or pre-owned items that are in good condition. These items often come at a lower price compared to brand new ones. Another alternative is to explore rental or leasing options if the item is not something you will need long-term. Additionally, consider researching for upcoming sales or discounts that may be available, so you can make your purchase at a reduced cost.