Curiosity has always been the driving force behind human progress, pushing us to explore uncharted territories and challenge established norms. In the realm of finance, this inherent curiosity has led to a growing fascination with alternative forms of money. These unconventional currencies, often shrouded in mystery and intrigue, offer a glimpse into a world where innovation meets economic value.

Without the constraints of traditional systems, alternative currencies represent a diverse array of concepts and mechanisms. From local community-based currencies to digital cryptocurrencies, each form presents a unique solution to the limitations of conventional money. These alternative systems embody the power of imagination, allowing individuals and communities to redefine the very essence of value itself.

The allure of alternative currencies lies not only in their potential practical applications but also in the underlying philosophy they embody. In a world dominated by centralized financial systems, these unconventional forms of money offer a decentralization of power and control. They empower individuals to take charge of their economic destiny, fostering a sense of autonomy and self-reliance.

Embracing alternative currencies also invites us to question and challenge long-held assumptions about the nature of money. Encouraging thought-provoking discussions on topics such as trust, value, and exchange, they open up new avenues for understanding the complex dynamics of our economic systems. By engaging with these alternative forms, we embark on a journey to reshape our perceptions and reevaluate the very foundations upon which our monetary frameworks are built.

The Enchantment with Alternative Modes of Currency:

In today's ever-evolving financial landscape, there exists an intrinsic fascination with unconventional means of exchanging value. This captivating allure towards alternative forms of money arises due to various factors, ranging from a desire for financial independence and privacy to a deep-rooted fascination with the possibilities enabled by innovative technologies. These alternative currencies represent a departure from traditional monetary systems and offer individuals and communities a fresh perspective on the concept of wealth and value exchange.

One compelling element that captivates the imagination is the notion of decentralization. Unlike traditional currencies issued and regulated by central banks, alternative forms of money operate through decentralized networks, independent of any government or financial institution. This decentralization empowers individuals by granting them greater control over their finances and eliminating the need for intermediaries. It simultaneously engenders trust and transparency, as transactions within these alternative systems are often publicly recorded on blockchain technology.

- One prominent alternative currency that has captured widespread attention is cryptocurrency. These digital assets utilize cryptographic technology to secure transactions and control the creation of new units. Bitcoin, the world's first cryptocurrency, has witnessed phenomenal growth, becoming a symbol of the potential for financial revolution.

- Another intriguing form of alternative currency is local or community-based currencies. These systems are designed to serve a specific geographic area or community and encourage economic self-sufficiency by promoting local trade and supporting local businesses.

- Complementary currencies, on the other hand, aim to supplement traditional money by facilitating the exchange of goods and services within a specific network. These currencies can help address economic inequalities and foster collaboration among participants.

Furthermore, alternative forms of money are often associated with values such as sustainability and social impact. Many communities and organizations have adopted time-based currencies, where units of value are measured in terms of hours or services rendered. This approach encourages the recognition and appreciation of non-monetary contributions, fostering a sense of community and cooperation.

This captivating fascination with alternative forms of money stems from a fundamental human desire for autonomy, exploration, and the pursuit of financial systems that align with personal values and aspirations. As technology continues to advance, innovators and visionaries will undoubtedly continue to explore new frontiers in currency, reshaping the way we perceive and interact with financial systems.

The Emergence of Cryptocurrencies: Exploring the Digital Revolution in Financial Transactions

In this section, we will delve into the rapid growth and impact of cryptocurrencies, an innovative form of digital money that has captured global attention and transformed the landscape of financial transactions.

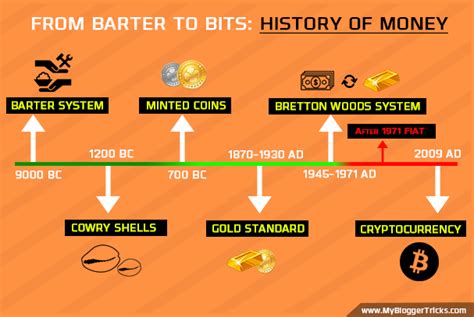

From Barter to Bitcoin: A Historical Overview of Alternative Currency Systems

In this section, we will delve into the evolution of various forms of currency throughout history, tracing the journey from traditional bartering systems to the emergence of modern digital currencies like Bitcoin. We will explore the diverse range of alternative currency systems that have fascinated societies across different time periods and regions. By examining the development and impact of these alternative currencies, we can gain valuable insights into the ever-changing nature of transactions and economic systems.

Before the advent of standardized forms of money, societies relied on barter as the primary method of exchange. This ancient practice involved the direct exchange of goods and services between individuals, without the need for a commonly accepted medium of exchange. We will explore the advantages and limitations of bartering systems, such as the challenges of finding a mutually beneficial trade and the inefficiency of exchanging goods on a large scale.

As societies advanced and trade expanded, various alternative currency systems emerged to address the limitations of bartering. These systems encompassed a wide range of forms, including commodity money, such as shells, beads, and precious metals, as well as representative money, such as tokens and promissory notes. We will provide examples of these alternative currencies and analyze their role in facilitating economic transactions.

The transition from physical forms of alternative currency to the digital realm brought about a new wave of innovation. With the rise of the internet, virtual currencies became possible, enabling people to carry out transactions online without the need for physical coins or banknotes. The introduction of Bitcoin sparked a revolution in the world of finance, as it offered a decentralized and secure means of transferring value. We will explore the key features of digital currencies and their impact on traditional financial systems.

By studying the historical progression of alternative currency systems, we can gain a deeper understanding of how societies have evolved in their approach to exchange and value. The exploration of various forms of money highlights the ever-present human fascination with finding alternative means of conducting transactions. Whether driven by practical necessity, social experimentation, or technological advancements, the quest for alternative currencies continues to shape the global financial landscape.

| Key Points: |

|---|

| - Evolution from bartering to digital currencies |

| - Advantages and limitations of bartering systems |

| - Exploration of commodity money and representative money |

| - Rise of virtual currencies and the impact of Bitcoin |

| - The ongoing fascination with alternative currency systems |

Local Currencies: Nurturing Stronger Communities through Alternative Modes of Transaction

In today's globalized world, economies are increasingly interconnected, yet at the same time, communities are seeking ways to foster a deeper sense of local identity and strengthen social bonds. Local currencies emerge as a compelling alternative means of exchange that not only fulfill practical functions but also provide opportunities for communities to flourish.

Community Empowerment: Local currencies empower communities by allowing residents to support local businesses, artisans, and vendors. By carrying out transactions in a local currency, individuals become active participants in nurturing the growth of their neighborhoods. This creates a sense of belonging and pride, instilling a renewed commitment towards the local community.

Economic Resilience: Local currencies help build stronger and more resilient local economies. They stimulate local production and consumption, reducing dependence on external markets. During times of economic instability or crisis, local currencies serve as a buffer and can help communities weather the storm, ensuring a more stable and self-reliant economic system.

Social Cohesion: The use of local currencies fosters social cohesion by encouraging face-to-face interactions, trust-building, and community engagement. Local currencies often require participation in community events, fostering collaboration, and creating opportunities for individuals to connect and learn from one another.

Cultural Preservation: Local currencies provide a platform for celebrating and preserving cultural heritage. By incorporating local symbols, artwork, and historical references, these currencies serve as a reminder of the rich traditions and stories that make a community unique. The circulation of such currencies helps to perpetuate local culture and traditions for future generations.

In conclusion, local currencies offer more than just an alternate form of money. They present communities with a promising avenue to build stronger, more empowered, and prosperous neighborhoods. By embracing local currencies, communities can establish an inclusive system where economic, social, and cultural enrichment go hand in hand.

Beyond Paper: Exploring the World of Digital Currencies and Cashless Transactions

In this section, we will delve into the realm of digital currencies and the ever-evolving landscape of cashless transactions. As society becomes increasingly interconnected and reliant on technology, the concept of traditional paper money is being reimagined and replaced by alternative forms of currency that exist solely in digital realms. This shift presents both opportunities and challenges, as we navigate a future where financial transactions are conducted without physical cash or tangible representations.

Within this digital realm, various types of cryptocurrencies have emerged, including widely known examples such as Bitcoin and Ethereum. Unlike traditional currencies issued by government entities, these cryptocurrencies are decentralized, using sophisticated encryption techniques to regulate and verify transactions. This decentralization promises increased security, autonomy, and transparency in financial transactions but also raises concerns regarding regulatory oversight and potential market volatility.

With the rise of digital currencies, an array of innovative cashless transaction methods has also emerged. From mobile payment platforms to contactless cards and wearable devices, our society is embracing new ways to exchange value without the need for physical currency or traditional banking systems. These technologies offer convenience, speed, and enhanced security, but they also pose questions about privacy, accessibility, and the potential for exclusion of those who may not have access to the necessary devices or internet connectivity.

Looking beyond the practical implications, the appeal of digital currencies and cashless transactions extends beyond mere convenience. For some, these alternatives represent a vision of a future where financial systems are more inclusive, transparent, and democratic. Proponents of digital currencies argue that they could allow individuals to have greater control over their money, transcend national boundaries, and reduce reliance on traditional financial institutions. However, it is essential to critically examine the potential risks, such as cyber threats, fraud, and the exacerbation of socio-economic inequalities, that may arise in this new era of digital finance.

Although the world of digital currencies and cashless transactions may seem distant and abstract, it is crucial to explore and understand its implications. As the global financial landscape continues to evolve, we must grapple with the opportunities and challenges presented by these alternative forms of exchange. Through careful examination, we can evaluate the potential benefits and risks associated with a future beyond paper money, guiding us towards an informed and responsible adoption of digital currencies and cashless transactions.

Tokens and Vouchers: Transforming the Economy through Non-Conventional Forms of Currency

In this section, we will delve into the intriguing realm of tokens and vouchers, powerful instruments that have emerged as alternative currency forms, reshaping economies worldwide. These unique manifestations of value exchange offer innovative ways to conduct transactions, foster community interaction, and challenge traditional notions of money.

1. Diversity of Tokens: One aspect of this fascinating trend is the diverse range of tokens that have gained popularity. These tokens, often representing a specific service or product, provide a means of exchange that departs from the traditional monetary system. From loyalty points and gift cards to digital coins and specialized tokens tied to particular industries, the possibilities seem endless. We will explore the various types of tokens and their specific applications within the economy.

2. The Rise of Vouchers: Vouchers, another form of alternative currency, have experienced a surge in popularity in recent years. These prepaid instruments offer individuals the freedom to obtain goods or services without the limitations imposed by traditional money. Whether through government welfare programs, community initiatives, or commercial ventures, vouchers have become a means of supporting local businesses, promoting social welfare, and forging connections within communities.

3. Impact on Economic Dynamics: Tokens and vouchers not only challenge conventional notions of money, but also reshape the economic landscape. As these alternative currency forms gain prominence, they introduce new dynamics to local and global economies. By fostering innovative payment methods, encouraging consumer loyalty, and promoting localized economic growth, tokens and vouchers play a pivotal role in shaping the economic interactions between individuals, businesses, and communities.

4. The Potential for Change: Lastly, we will explore the potential of tokens and vouchers to revolutionize the way we perceive and utilize money. As these alternative currency forms continue to evolve, their potential for driving economic change and creating new avenues of exchange becomes increasingly evident. We will delve into the possibilities for a future where tokens and vouchers become integral components of mainstream economic systems.

In this section, we will uncover the captivating world of tokens and vouchers, examining their diverse forms, impact on the economy, and potential for transforming our understanding of money. Join us as we navigate this uncharted territory and uncover the power of alternative currency forms in shaping the future of economies worldwide.

Investing in the Future: The Potential Benefits and Risks of Alternative Currencies

Looking beyond traditional monetary systems, the concept of alternative currencies has gained momentum in recent years, captivating the imaginations of many individuals and businesses. This section delves into the potential benefits and risks associated with investing in these innovative forms of exchange.

Uncovering the Advantages

Embracing alternative currencies involves straying from the beaten path, challenging the established norms and venturing into uncharted territory. One of the potential benefits lies in the diversification of investment portfolios. By allocating a portion of funds towards these unconventional mediums of exchange, investors open themselves up to potential gains that can be decoupled from traditional financial systems and economic developments.

Moreover, alternative currencies often operate on decentralized platforms, relying on blockchain technology or other innovative mechanisms. This decentralization can offer individuals increased control over their finances, reducing reliance on centralized authorities and their associated regulations. The ability to transact directly with other participants, regardless of geographical barriers, can foster financial inclusivity and provide new avenues for economic growth.

Examining the Risks

While alternative currencies hold great promise, investors must also be aware of the risks that come with this emerging market. The volatility and speculative nature of these currencies present a significant challenge. Fluctuations in value can be dramatic, heightening the potential for significant losses. It is crucial for investors to thoroughly research and understand the specific dynamics of each alternative currency before making any investment decisions.

In addition, the limited acceptance and adoption of alternative currencies pose both challenges and opportunities. The success of any currency depends on its widespread use and recognition as a medium of exchange. Without sufficient acceptance, these currencies may struggle to gain traction and maintain value. Investors must carefully assess the market demand for a particular alternative currency and its potential for growth before committing funds to it.

In conclusion, exploring alternative currencies can pave the way for new investment opportunities and financial freedoms, offering unprecedented advantages. Yet, investors should approach this market with caution, taking into consideration the risks associated with the volatility and acceptance of these currencies. By balancing the potential benefits and risks, individuals and businesses can make informed investment decisions and contribute to the future evolution of the global financial landscape.

Breaking Barriers: Alternative Currencies as Tools for Financial Inclusion and Empowerment

In this section, we will explore the potential of alternative currencies in breaking down barriers and promoting financial inclusion and empowerment. By challenging traditional monetary systems and providing diverse avenues for economic transactions, alternative currencies offer individuals and communities the opportunity to take control of their finances and participate fully in the economy, irrespective of socio-economic status or geographic location.

One of the key advantages of alternative currencies is their ability to foster inclusivity. Unlike mainstream currencies that are issued and regulated by central banks, alternative currencies present a decentralized and community-driven approach. These currencies can be tailored to meet specific needs, such as supporting local businesses, encouraging sustainable practices, or facilitating peer-to-peer transactions. By providing an alternative medium of exchange, these currencies empower marginalized individuals and communities, allowing them to participate actively in economic activities and gain financial independence.

- Alternative currencies bridge the gap between the unbanked and the formal financial system. Many individuals, particularly in developing countries or underserved communities, lack access to basic banking services. Alternative currencies, often operating through digital platforms or mobile applications, can provide a means for these individuals to store value, make transactions, and save money without the need for a traditional bank account. This financial inclusion not only facilitates economic growth but also promotes social development and poverty alleviation.

- Additionally, alternative currencies can serve as tools for empowerment, challenging the dominance of centralized financial institutions. By shifting the power dynamics in financial transactions, these currencies offer individuals and communities greater control over their economic destinies. They encourage collaboration, mutual support, and economic resilience within communities, fostering a sense of ownership and self-determination.

- Furthermore, alternative currencies promote local economic development by encouraging local circulation and sustainable practices. By prioritizing the use of these currencies within a community, individuals are motivated to support local businesses and producers, thereby strengthening the local economy and reducing dependence on external sources. This localized approach also promotes environmentally-friendly practices, as alternative currencies can incorporate sustainability objectives, rewarding individuals for engaging in eco-conscious behaviors.

In conclusion, alternative currencies break barriers by offering inclusive financial solutions that empower individuals, promote economic participation, and challenge the traditional monetary systems. These currencies enable financial inclusion for the unbanked, foster economic empowerment and self-determination, and support local economic development and sustainable practices. The fascination with alternative forms of money stems from their potential to create a more equitable and inclusive financial landscape for all.

FAQ

What is the fascination behind alternative forms of money?

The fascination with alternative forms of money lies in the desire for financial innovation and exploration. People are curious about different ways to exchange value and challenge the traditional monetary system.

What are some examples of alternative forms of currency?

Some examples of alternative forms of currency include cryptocurrencies like Bitcoin and Ethereum, local community currencies such as the Bristol Pound in the UK, and even time-based currencies like Time Dollars.

How do alternative forms of money impact the traditional financial system?

Alternative forms of money can potentially disrupt the traditional financial system by offering decentralized, peer-to-peer, and sometimes more efficient ways of conducting transactions. This can redefine the concept of trust and challenge the dominance of traditional banking institutions.

What are the potential benefits and drawbacks of alternative currencies?

The potential benefits of alternative currencies include increased financial inclusion, reduced transaction costs, and the possibility of bypassing government control. However, drawbacks can include regulatory challenges, increased volatility, and potential for facilitating illegal activities.