Picture this: a state of mind where your financial equilibrium appears to be caught in a whirlpool of undesirable figures, pulling you towards a realm of disillusionment and distress. A scenario where the numbers on your statement mirror a disposition contrary to your desires, leaving you yearning for stability and solace. Delving into the implications of such a predicament and seeking viable remedies becomes paramount, for a negative bank balance entails far-reaching consequences.

It is within the intricacies of predicaments like these that one finds oneself compelled to unravel the complexities and decipher the underlying causations. Akin to a labyrinth, the implications of a dwindling financial state can have far-reaching effects on one's emotional, mental, and even physical well-being. The heavy burden of debt and the lack of financial security can lay a heavy toll, casting a somber pall over the individual's life, eroding joy and diminishing dreams.

But fret not, for within the gloom lies a glimmer of hope - a pathway to redemption and rejuvenation. Understanding the root causes of a negative financial balance is the first step towards effecting a change. An astute comprehension of the factors that contribute to this predicament can help one navigate through the maze of financial uncertainty, emerging on the other side stronger and wiser. As we dare to dream of a more prosperous future, equipped with knowledge and determination, the journey towards reversing the tides becomes attainable.

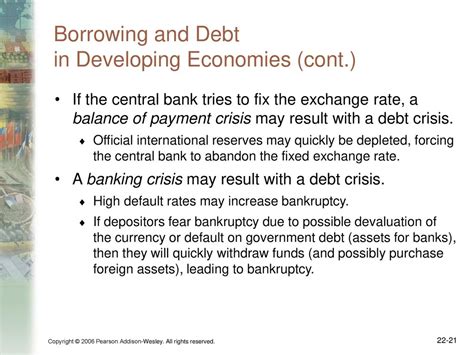

Recognizing the Financial Ramifications: An Insight into the Consequences of a Depleted Banking Balance

The Financial Ripple Effect: In this section, we delve into the wide-ranging ramifications that come hand in hand with a negative bank account balance. By comprehending the intricacies of such a situation, individuals gain a heightened understanding of the extensive impact it can have on their overall financial well-being and stability.

A Vicious Cycle: Here, we explore how a depleted bank account can act as a catalyst for a relentless cycle of financial strain. From mounting debt to limited access to credit, individuals find themselves caught in a web of unfavorable circumstances that exacerbate their financial challenges.

Impaired Financial Opportunities: This segment sheds light on the adverse effects a negative bank account can have on future prospects. From hindering the ability to secure loans, mortgages, or favorable interest rates to impacting employment opportunities, individuals are faced with limited financial freedom and potential hurdles in achieving their goals.

The Emotional Toll: We discuss the emotional toll that a negative bank account takes on individuals, examining the stress, anxiety, and uncertainty that ensue. The psychological impact of financial strain is acknowledged, emphasizing the importance of addressing and rectifying the situation as soon as possible.

The Road to Recovery: Finally, we provide insights and practical advice on how individuals can begin to turn their financial situation around. We highlight potential strategies, such as budgeting, debt management, and seeking professional assistance, to empower individuals to regain control and work towards a healthier financial future.

Overall, this section delves into the profound implications that arise from having a depleted bank account. By recognizing the wide-reaching consequences and exploring avenues for improvement, individuals can take proactive steps towards regaining financial stability and setting themselves up for future success.

The Impact of an Adverse Bank Account Balance on Your Credit Score

When your bank account balance falls into the negative, it can have significant consequences for your credit score. Understanding these implications is essential to taking the necessary steps to improve your financial situation.

Having an adverse bank account balance can adversely affect your credit score in multiple ways. First and foremost, it demonstrates to lenders and credit agencies that you are struggling to manage your finances effectively. This can make lenders hesitant to extend credit to you, or they may offer you credit at higher interest rates.

Furthermore, a negative bank account balance may lead to missed or bounced payments, which can heavily impact your credit score. When payments towards credit cards, loans, or other financial obligations cannot be fulfilled due to insufficient funds in your account, your creditworthiness is called into question.

In addition to damaging your credit score, an adverse bank account balance can also lead to the accumulation of debt. Overdraft fees and other penalties associated with having a negative balance can quickly add up, making it even more challenging to regain financial stability.

- Monitor Your Account Regularly: Keeping a close eye on your bank account balance can help you prevent it from falling into negative territory. Promptly addressing any discrepancies or issues can minimize the impact on your credit score.

- Create a Budget and Stick to It: Developing a comprehensive budget that accounts for your income and expenses will help you manage your finances effectively and avoid overspending.

- Build an Emergency Fund: Establishing an emergency fund can provide a safety net in case of unexpected expenses or income disruptions, reducing the risk of a negative bank account balance.

- Communicate with Your Creditors: If you find yourself unable to make payments due to a negative bank account balance, reaching out to your creditors and explaining your situation can potentially help you negotiate more manageable repayment terms.

- Seek Professional Advice: If you are struggling to turn around a negative bank account balance and its impact on your credit score, consider consulting with a financial advisor or credit counselor who can provide personalized guidance.

By taking proactive steps to address a negative bank account balance and mitigate its impact on your credit score, you can work towards improving your financial standing and achieving your long-term financial goals.

How a Negative Bank Account Affects Your Financial Freedom and Future Opportunities

When faced with a deficit in your financial resources, it is crucial to understand the profound ramifications it can have on your overall financial freedom and the potential opportunities that lie ahead. A negative balance in your bank account can severely restrict your ability to meet expenses, save for the future, and pursue the goals that are important to you.

One primary way in which a negative bank account impacts your financial freedom is by limiting your ability to cover essential expenses. Without sufficient funds, you may find yourself unable to pay bills, meet rent or mortgage obligations, and cover day-to-day living costs. This can lead to missed payments, late fees, and a downward spiral of accumulating debt.

Furthermore, a negative bank account can hinder your ability to save for the future and build a solid financial foundation. It becomes challenging to set money aside for emergencies, retirement, or any long-term goals you may have. Without the ability to save, you risk falling into a cycle of financial instability and dependence on credit.

In addition to these immediate constraints, a negative bank account can have long-term implications on your overall financial well-being. It can impact your credit score, making it difficult to secure loans or obtain favorable interest rates in the future. This can limit your access to essential financial resources and opportunities, such as buying a home or starting a business.

Moreover, a negative bank account can negatively impact your mental and emotional well-being. The stress and anxiety associated with constantly being in a state of financial instability can take a toll on your overall quality of life, affecting both your personal and professional endeavors.

To turn this situation around and regain your financial freedom, it is essential to take proactive steps towards recovery. This may involve creating a strict budget, cutting unnecessary expenses, seeking additional sources of income, and exploring options for debt consolidation or repayment plans. By taking control of your financial situation, you can pave the way for a brighter future, with opportunities for wealth accumulation, financial stability, and increased personal fulfillment.

Financial Freedom:

| Future Opportunities:

|

The Emotional Toll of Having a Deficit in your Financial Balance and Strategies to Overcome It

Experiencing the repercussions of a lack of funds can have a profound impact on an individual's psychological well-being. The mental strain associated with having a negative bank balance goes beyond the mere absence of financial security. It has the potential to evoke feelings of stress, anxiety, and hopelessness, exacerbating an already challenging situation.

1. Acknowledge and Address Negative Emotions:

It is essential to recognize the emotions that arise from facing a negative bank account and take steps to address them. Denying or suppressing these feelings can further escalate the psychological toll. Instead, it is crucial to embrace them, allowing yourself to acknowledge the impact they have on your mental state. By doing so, you can begin to take steps towards proactively managing and improving your financial situation.

2. Seek Support and Open Up:

Sharing your concerns with trusted friends, family members, or financial advisors can provide much-needed emotional support. Opening up about your struggles can help alleviate feelings of isolation and provide an opportunity for receiving practical advice or guidance. Remember that many individuals have faced similar challenges before and may offer insights from their own experiences.

3. Develop a Practical Action Plan:

Crafting a realistic plan to address your negative bank account can give you a sense of control over your financial situation. Begin by identifying expenses that can be reduced or eliminated, exploring potential ways to increase your income, and creating a budget to effectively manage your finances. Breaking down your plan into manageable steps can reduce feelings of overwhelm and provide a clear path towards improvement.

4. Cultivate a Positive Mindset:

Refocusing your thoughts and cultivating a positive mindset is crucial when dealing with a negative bank account. While it may seem challenging at first, embracing a positive outlook can help reduce stress and foster resilience. Practice gratitude for the things you do have, celebrate every small win, and believe in your ability to turn the situation around. Remember, setbacks are temporary, and a positive mindset can propel you towards financial stability.

5. Educate Yourself and Seek Financial Literacy:

Lack of financial knowledge often plays a role in finding oneself in a negative bank account situation. Invest time in educating yourself about personal finance, budgeting, and money management. Numerous online resources, books, and courses are available to enhance your financial literacy. Equipping yourself with this knowledge will empower you to make informed decisions and prevent future financial difficulties.

6. Celebrate Progress and Practice Self-Care:

Finally, remember to celebrate every step forward, regardless of how small it may seem. Recognize the efforts you are making to overcome the negative bank account situation and reward yourself accordingly. Additionally, prioritize self-care to manage stress, such as exercise, meditation, or engaging in activities that bring you joy. Taking care of your mental well-being is crucial during challenging financial times.

Overcoming the psychological toll of a negative bank account requires determination, resilience, and a proactive approach towards improving your financial situation. By addressing negative emotions, seeking support, developing a practical action plan, cultivating a positive mindset, educating yourself, and practicing self-care, you can gradually regain control over your finances and build a more secure future.

Steps to Improve Your Financial Situation by Reverse Turning Around a Depleted Financial Balance

In this section, we will explore a range of effective strategies and practical steps that can be taken to reverse a negative bank account and ultimately enhance your overall financial circumstances. By implementing these approaches, you can regain control over your financial stability and work towards a more prosperous future.

- Evaluate your current financial situation by conducting a thorough assessment of your income, expenses, and debts. Identifying the root causes of your negative bank account will help you develop targeted solutions.

- Create a detailed budget that prioritizes necessary expenses while minimizing non-essential spending. This will allow you to allocate your funds more effectively and prevent further financial strain.

- Explore potential additional sources of income, such as part-time or freelance work. Generating extra revenue streams can accelerate the process of replenishing your bank account.

- Implement cost-cutting measures, such as reducing unnecessary subscriptions, negotiating lower interest rates on loans and credit cards, or finding more affordable alternatives for your regular expenses.

- Develop a debt repayment plan by focusing on high-interest debts first or employing strategies like the debt snowball or debt avalanche methods.

- Seek financial guidance from professionals, such as financial advisors or credit counselors. They can provide personalized advice based on your unique circumstances and assist you in making informed financial decisions.

- Consider consolidating your debts into a single loan with a lower interest rate. This can simplify your repayment process and potentially reduce the overall amount you owe.

- Build an emergency fund by setting aside a portion of your income each month. Having a financial cushion can protect you from future unexpected expenses and reduce the risk of falling back into a negative bank account.

- Monitor your progress regularly by analyzing your bank statements and tracking your expenses. This will allow you to stay accountable and make necessary adjustments to your financial habits and goals.

- Stay motivated and maintain a positive mindset throughout your financial journey. Recognize that turning around a negative bank account requires time and effort, but with persistence and determination, you can achieve a healthier and more secure financial future.

By implementing these steps and taking proactive measures, you can reverse the negative balance in your bank account and pave the way for a brighter financial future. Remember, every small action counts, and with consistency and dedication, you can gradually improve your financial situation and achieve long-term financial stability.

FAQ

What are the implications of having a negative bank account?

Having a negative bank account can lead to various financial consequences. It may result in overdraft fees, bounced checks, and potential legal actions taken by the bank. It can also damage your credit score and make it difficult to open new accounts or obtain loans in the future.

How does one end up with a negative bank account?

There are several ways to end up with a negative bank account. It can happen if you spend more money than you have in your account, if you use overdraft protection and exceed your limit, or if you have pending transactions that are deducted before your deposits are processed. Additionally, fees and charges can push your account into negative territory.

What steps can be taken to turn around a negative bank account?

To turn around a negative bank account, it is important to first assess your financial situation and create a budget. Cut unnecessary expenses, prioritize payments, and focus on income generation. Communicate with your bank to explore options such as overdraft protection or setting up a payment plan. Consider seeking professional advice from a financial advisor or credit counselor to help you develop a plan to get back on track.

Can a negative bank account affect your credit score?

Yes, a negative bank account can have a negative impact on your credit score. If you fail to repay the negative balance and the account is closed, the bank may report it to credit bureaus, resulting in a lower credit score. This can make it difficult to borrow money or obtain credit in the future.

How long does it take to recover from a negative bank account?

The time it takes to recover from a negative bank account depends on various factors such as the amount of debt, your income, and your financial discipline. With careful budgeting, consistent payments, and responsible financial management, it is possible to recover within a few months to a year. However, it's important to seek professional advice if you're struggling to get back on track.