Embarking on new financial endeavors often involves careful assessment and consideration of various aspects. One such area that can significantly impact an individual's financial journey is loans. Whether aiming to invest in a new property, start a business venture, or pursue higher education, loans come into play as a supportive tool. However, understanding the key factors accompanying loans becomes imperative before diving into any financial commitment. This article sheds light on the crucial elements that should be taken into account when contemplating loans, enabling individuals to make informed decisions and navigate the lending terrain with confidence.

1. Financial Stability: Before taking the plunge into the realm of loans, it is essential to evaluate one's own financial stability. This includes examining income sources, existing debts, and expenditure patterns. By analyzing these factors, individuals can gain a clear understanding of their financial standing and determine whether acquiring a loan aligns with their current monetary situation.

2. Interest Rates and Repayment Terms: The next aspect to consider revolves around interest rates and repayment terms. Each loan option comes with its unique interest rate structure, impacting the overall financial obligation. Potential borrowers must meticulously assess these rates and understand the implications they have on the repayment period. Additionally, comprehending the terms and conditions associated with loan repayment ensures that borrowers are aware of any potential penalties or fees.

3. Loan Purpose and Duration: Another crucial factor to take into account is the purpose and duration of the loan. Different loan types cater to diverse financial needs, such as mortgages, personal loans, or student loans. By identifying the specific purpose of the loan, individuals can streamline their search towards options that best suit their requirements. Furthermore, understanding the loan duration plays a vital role in developing a realistic repayment plan and estimating the overall cost of borrowing.

4. Credit History and Eligibility: Lending institutions often assess an individual's credit history to determine their eligibility for a loan. Maintaining a good credit score increases the chances of securing favorable loan terms, while a poor credit history may limit borrowing options or result in higher interest rates. By reviewing one's credit report and addressing any red flags or discrepancies, potential borrowers can optimize their creditworthiness and improve their eligibility for loan approvals.

In conclusion, loans serve as significant financial tools. However, approaching loans with due diligence and awareness of key factors is essential in making sound financial decisions. Understanding personal financial stability, evaluating interest rates and repayment terms, identifying loan purpose and duration, and ensuring a healthy credit history are all crucial considerations. By delving into these factors and conducting comprehensive research, individuals can confidently navigate the lending landscape, ultimately achieving their financial aspirations.

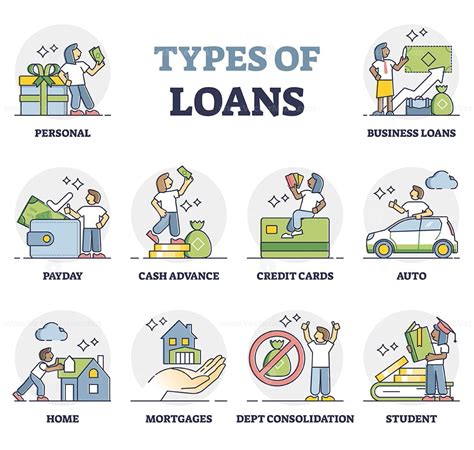

Understanding the Various Types of Loans

Exploring the diverse realms of borrowing money can be a complex and daunting undertaking. A comprehensive understanding of the different types of loans is crucial to make informed financial decisions. From personal loans to mortgages, each loan type presents unique features, terms, and conditions that cater to specific needs and circumstances. This section aims to shed light on the various loan options available and provide a solid foundation for borrowers.

Personal Loans: These are versatile loans that can be used for a wide range of purposes, such as debt consolidation, home improvements, or unexpected expenses. Unlike secured loans, personal loans typically do not require collateral, making them accessible to a broader audience. Interest rates and repayment terms may vary based on the borrower's credit history and income.

Mortgages: The dream of homeownership often necessitates acquiring a mortgage loan. This type of loan enables individuals to purchase property by borrowing funds from a financial institution. The property acts as collateral to secure the loan, and the borrower typically makes monthly payments over an extended period, spanning several years. Mortgage loans come in various forms, including fixed-rate mortgages and adjustable-rate mortgages, each offering distinct benefits and considerations.

Student Loans: As education costs continue to rise, many individuals rely on student loans to pursue their academic dreams. These loans are specifically tailored to cover tuition fees, books, and living expenses during the educational journey. The terms and conditions of student loans may vary, including interest rates, repayment plans, and forgiveness options. Considering the long-term impact of student loans, it is essential to evaluate repayment options and potential financial burdens before committing to this type of loan.

Business Loans: Entrepreneurs and business owners often turn to business loans to fund their ventures or expand existing operations. These loans can provide the necessary capital to cover start-up costs, purchase equipment, hire staff, or invest in marketing initiatives. Lenders assess various factors, such as business plans, revenue projections, and credit history when considering business loan applications. Understanding the different types of business loans, such as term loans, lines of credit, or SBA loans, is crucial to meet specific funding requirements.

Auto Loans: For individuals looking to purchase a vehicle, auto loans offer a convenient solution. These loans provide the necessary funds to buy a car while allowing borrowers to repay the loan over a predetermined period. Interest rates for auto loans vary based on factors such as credit score, loan term, and vehicle type. Understanding the terms and conditions of auto loans is important to determine affordability and secure the best possible financing options.

Conclusion: Diving into the world of loans requires an understanding of the various types available. Whether it is personal loans, mortgages, student loans, business loans, or auto loans, each comes with its own unique considerations. By familiarizing oneself with these loan categories, individuals can make informed decisions based on their specific needs, financial capabilities, and future goals.

Assessing Your Financial Situation: Prior to Taking a Loan

Understanding and evaluating your current financial condition is essential before considering any loan. By thoroughly examining your financial standing, you can determine if borrowing money is a viable option for achieving your goals and minimizing potential risks.

Important Aspects to Evaluate When Selecting a Lender

When it comes to borrowing money, choosing a lender is a critical decision that should be approached with careful consideration. The selection of a lender directly impacts the terms and conditions, interest rates, and overall borrowing experience. Therefore, it is essential to thoroughly evaluate various key factors to ensure the most suitable lender is selected.

One crucial factor to consider is the interest rate offered by the lender. It is important to compare the interest rates of different lenders, as even a slight difference can significantly affect the total cost of borrowing. Additionally, evaluating the repayment terms and options is essential. Some lenders may offer flexible repayment schedules, while others may have strict repayment structures.

Another vital factor to assess is the lender's reputation and reliability. Researching the lender's history, customer reviews, and any potential red flags can provide valuable insights into their legitimacy and credibility. This helps in avoiding fraudulent or predatory lenders and ensures a secure borrowing experience.

Furthermore, evaluating the lender's customer service and support is crucial. Accessible and responsive customer service can greatly enhance the borrowing experience, as it provides assistance and guidance throughout the loan application and repayment process. Good communication and transparent policies from the lender contribute to a smooth and satisfactory borrowing relationship.

Additionally, it is important to consider any additional fees or charges associated with the loan. Some lenders may have hidden costs or penalties, such as origination fees or prepayment penalties. Carefully reviewing and understanding the loan agreement and associated costs helps in making an informed decision and avoiding any unexpected financial burdens.

| Key Factors to Consider When Choosing a Lender: |

|---|

| - Interest rates |

| - Repayment terms and options |

| - Lender's reputation and reliability |

| - Customer service and support |

| - Additional fees and charges |

Evaluating the Terms and Conditions of Loans

As we embark on the journey of acquiring loans, it becomes essential to thoroughly assess and evaluate the terms and conditions that accompany them. This section aims to provide a comprehensive understanding of the factors that should be considered while examining the terms and conditions of loans, without delving into specific definitions.

The Significance of Repayment Plans and Interest Rates

Within the realm of loans, comprehending the significance of repayment plans and interest rates is of utmost importance. These two factors play a crucial role in determining the overall cost and feasibility of borrowing money. Whether considering various loan options or evaluating the affordability of a specific loan, understanding how repayment plans and interest rates work can make a significant difference in one's financial well-being. This section will delve into the vital aspects of repayment plans and interest rates, highlighting their impact on loan terms and ultimate financial obligations.

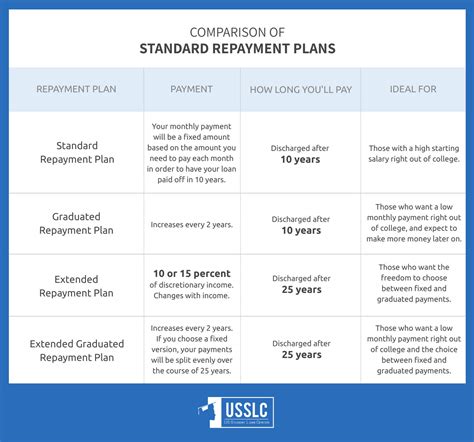

1. Repayment Plans: When considering borrowing money, it is essential to assess the variety of repayment plans available. Repayment plans refer to the structure and duration in which borrowed funds are expected to be repaid. These plans can vary, offering different terms, options, and flexibility based on individual needs and preferences. Some common types of repayment plans include fixed-term plans, graduated plans, and income-driven plans. Each plan has its own advantages and considerations, and selecting the appropriate repayment plan can significantly impact the ease and affordability of loan repayment.

2. Interest Rates: Another crucial factor to consider when contemplating loans is the interest rate associated with the borrowed funds. Interest rates represent the cost of borrowing money and are expressed as a percentage of the loan amount. The interest rate determines the additional amount that borrowers must repay on top of the original loan principal. Understanding the different types of interest rates, such as fixed rates and variable rates, is essential for evaluating the long-term financial implications of borrowing. Lower interest rates generally result in lower overall borrowing costs, making them more favorable for borrowers.

- Effects on Affordability: The combination of repayment plans and interest rates has a direct impact on the affordability of loans. For example, longer repayment terms may result in lower monthly installments, but they could lead to higher interest costs over time. Conversely, shorter repayment terms may require higher monthly payments but can save borrowers money on interest. Evaluating different repayment plans alongside their associated interest rates can help borrowers choose an option that aligns with their financial capabilities and goals.

- Risk Management: Repayment plans and interest rates also play a crucial role in managing the risk associated with loans. High-interest rates can increase the overall financial burden and make it more challenging for borrowers to repay their debts. Similarly, choosing repayment plans with inadequate flexibility can lead to financial strain if unexpected circumstances arise. By thoroughly considering repayment plans and interest rates, borrowers can mitigate risks and ensure that they can comfortably manage their loan obligations.

In conclusion, comprehending the importance of repayment plans and interest rates is vital for anyone considering borrowing money. These factors directly influence the cost, feasibility, and overall financial impact of loans. By thoroughly assessing the available repayment plans and interest rates, borrowers can make well-informed decisions that align with their financial goals and circumstances.

FAQ

What are the key factors to consider when dreaming about loans?

When considering loans, there are several key factors to keep in mind. Firstly, it's important to think about your overall financial situation and whether taking on a loan is a viable option for you. You should also consider your credit score as this will impact the interest rates offered to you. Additionally, it's important to compare different loan options and shop around for the best rates and terms. Finally, you should carefully read and understand the terms and conditions of any loan before committing to it.

How does my credit score affect my loan options?

Your credit score plays a significant role in determining the loan options available to you. A higher credit score indicates a lower risk for lenders, making you eligible for lower interest rates and better loan terms. Conversely, a lower credit score may limit your loan options or result in higher interest rates. It's important to regularly check your credit score and work on improving it if necessary before applying for a loan.

Why is it important to compare different loan options before making a decision?

Comparing different loan options allows you to find the best terms and rates that suit your financial situation. Different lenders may offer varying interest rates, loan amounts, repayment periods, and additional fees. By comparing multiple options, you can ensure that you choose the loan that best meets your needs and minimizes the total cost of borrowing. This can potentially save you money in the long run and make loan repayment more manageable.