Picture yourself in a sanctuary, an abode that represents your aspirations, a place that reflects your individuality and serves as the canvas for your cherished memories. Seeking a dwelling that captures the essence of your desires is an inherent human instinct; a universal pursuit that evokes a multitude of emotions. From yearning for a cherished sanctuary to embarking on a quest for the perfect haven, the dream of homeownership is a journey worth pursuing.

Throughout history, we have sought solace and security in architecture; brick and mortar structures that evolve with the dynamics of our lives. A residence is more than just a building; it is an embodiment of our innermost dreams, a haven that nurtures our growth and offers solace during the highs and lows of life. Beyond fulfilling basic needs, a house becomes a vessel that encapsulates stories, aspirations, and cherished legacies.

Join us on a profound exploration of the labyrinthine pathways to acquiring your coveted sanctuary. Through this empowering guide, we will navigate through the nuances of home ownership - an expedition filled with anticipation, decision-making, and the realization of your deepest aspirations. Together, we will uncover the secrets to transforming your dreams into tangible reality, laying the groundwork for a future that exceeds your wildest expectations.

Embrace this transformative journey, armed with invaluable insights and protocols that will ensure your odyssey towards homeownership is a remarkably fulfilling one. Harnessing the power of knowledge and practical wisdom, we shall navigate the labyrinth of decision-making, financial planning, legal considerations, and the various aspects involved in sourcing your dream abode. With each chapter, we will delve deeper into the intricacies of the process, equipping you with the tools necessary to manifest the house you've always envisioned. Let us embark on this magnificent expedition together, building the foundation for a future filled with boundless joy and contentment.

The Power of Visualization: Manifesting Your Ideal Home

In this section, we will explore the immense influence that visualization can have on turning your aspirations into reality when it comes to finding your perfect place of residence. The process of visualization involves harnessing the power of your imagination to create a clear and vivid picture of your dream home.

When it comes to manifesting your ideal home, visualization serves as a powerful tool that helps align your thoughts, emotions, and actions towards achieving the desired outcome. By visualizing your dream home in detail, you form a deep connection with your aspirations, thereby attracting the right opportunities and resources to make it a reality.

Imagining yourself walking through the front door of your dream home, a feeling of warmth and comfort fills your senses. The embrace of natural light from large windows creates a cheery atmosphere, while the spacious rooms provide ample room for creativity and relaxation. The serene garden and patio area entice you to spend peaceful evenings outdoors, surrounded by nature's beauty.

Through the art of visualization, you can transform your dreams of home ownership into a tangible plan of action. By focusing on the details that matter most to you, such as the layout, architectural style, and location, you bring your vision to life in your mind's eye.

By consistently visualizing your dream home and affirming your belief in its manifestation, you program your subconscious mind to seek out opportunities and resources that will help turn your visualization into reality. This creates a powerful synergy between your thoughts, emotions, and actions, propelling you closer to your goal of owning your ideal home.

In conclusion, the power of visualization cannot be underestimated when it comes to manifesting your dream home. By harnessing your imagination and creating a clear mental image of your desired home, you align yourself with the energy and opportunities necessary to make it a reality. Embrace the process of visualization, believe in the manifestation of your dreams, and take inspired action towards achieving your goal of owning your dream home.

Understanding the Financial Aspect: Effective Savings Strategies for Realizing Homeownership Goals

In this section, we explore the key elements of the financial aspect when it comes to fulfilling your dreams of owning a spacious and vibrant residence. Without a doubt, being aware of and implementing effective savings strategies will play a crucial role in making your aspirations a reality.

To begin with, one of the fundamental aspects to consider is creating a well-defined budget that allows you to allocate a specific portion of your income towards your homeownership goal. This requires a careful evaluation of your current financial situation, including your income, expenses, and potential areas where you can cut back or reduce costs. By setting a realistic budget, you can develop a clear understanding of how much you can save each month towards your dream home.

Another essential savings strategy is the concept of "paying yourself first." This means making it a priority to set aside a certain percentage of your income specifically for saving towards your homeownership objective. By treating this amount as an essential expense rather than an afterthought, you ensure that your savings grow consistently over time and bring you closer to achieving your dream of owning a beautiful home.

Diligently tracking your expenses is another valuable tactic that can help streamline your savings journey. By closely monitoring your spending habits and identifying areas where you are overspending or splurging unnecessarily, you can make conscious adjustments and redirect those funds towards your savings goals. This disciplined approach not only helps you accumulate funds but also instills better financial habits that will benefit you in the long run.

In addition to budgeting and tracking your expenses, implementing strategies such as automatic savings transfers and separate savings accounts can further optimize your progress towards homeownership. Automated transfers allow you to effortlessly direct a predetermined portion of your income into a dedicated savings account, reducing the temptation to spend those funds. Similarly, having a separate savings account specifically designated for your homeownership aspirations enables you to easily track your progress and witness your savings grow over time.

Lastly, it is essential to continuously educate yourself about different savings mechanisms and investment opportunities that can accelerate your path towards homeownership. Whether it's exploring high-yield savings accounts, mutual funds, or other secure investment options, staying informed and seeking expert advice can help maximize your savings potential and expedite the process of turning your dream into a concrete reality.

| Key Takeaways: |

| - Creating a well-defined budget |

| - Implementing the "pay yourself first" strategy |

| - Tracking expenses and making conscious adjustments |

| - Utilizing automated savings transfers and separate accounts |

| - Staying informed about savings mechanisms and investment options |

The Significance of Credit Score: Enhancing and Sustaining It

Credit score plays a pivotal role in various financial aspects of our lives. Understanding its importance and knowing how to enhance and maintain it is crucial for achieving long-term financial stability. This section sheds light on the significance of credit score, explores effective strategies to improve it, and provides valuable insights for its ongoing maintenance.

1. Grasping the concept of credit score:

Credit score is a numerical representation of an individual's creditworthiness and financial reliability. It is an evaluation of one's credit history, consisting of factors such as payment history, credit utilization, length of credit history, types of credit used, and new credit inquiries. A high credit score indicates a good financial standing and enhances the ability to secure loans and favorable interest rates.

2. Strategies to enhance credit score:

Improving credit score requires diligent effort and time. Implementing these strategies can help individuals enhance their credit score and expand their financial opportunities:

a. Ensure timely payment of bills and debts. Punctual payments demonstrate financial responsibility and positively impact credit score.

b. Maintain a low credit utilization ratio. Keeping credit card balances low relative to the credit limit showcases good financial management.

c. Diversify credit portfolio. A mix of credit cards, loans, and mortgages showcases responsible credit usage.

d. Limit new credit applications. Frequent applications for new credit can raise concerns among lenders.

e. Regularly review credit reports. Identifying and addressing any errors or inaccuracies on credit reports is essential for maintaining an accurate credit score.

3. Long-term credit score maintenance:

Maintaining a healthy credit score is an ongoing process and requires consistent effort. The following tips can assist individuals in preserving a favorable credit score:

a. Continuously monitor credit utilization. Regularly assessing and managing credit card balances can help maintain a low credit utilization ratio.

b. Monitor credit reports annually. Staying vigilant and requesting credit reports from major credit bureaus ensures accurate information and provides an opportunity to identify and rectify any potential issues.

c. Avoid closing old credit accounts. Keeping old credit accounts open showcases a long credit history, which can positively impact credit score.

d. Act responsibly when seeking new credit. Prioritizing necessary credit and ensuring responsible borrowing practices can help avoid any negative impact on credit score.

e. Establish strong financial habits. Responsible financial management, such as budgeting, avoiding excessive debt, and saving, contributes to a positive credit score.

By understanding the significance of credit score and implementing the right strategies, individuals can navigate the world of credit with confidence, unlocking opportunities for home ownership and various other financial endeavors.

Finding the Ideal Location: Key Factors to Consider for Your Dream Residence

When embarking on the journey to find your dream house, one of the most crucial decisions you'll make is choosing the perfect location. Selecting the right site for your future residence is essential to ensure your long-term happiness and satisfaction. Factors such as proximity to amenities, accessibility, neighborhood characteristics, and future development plans play a significant role in determining the suitability of a location for your dream home.

To start with, the accessibility of the area should be given considerable thought. The availability of public transportation, major roadways, and proximity to airports and train stations can greatly impact convenience in commuting and traveling. Additionally, consider the distance to important places such as schools, hospitals, shopping centers, and recreational facilities to ensure easy access to essential services and amenities.

The characteristics of the neighborhood also deserve careful consideration. Take note of the general atmosphere, safety, and quality of life in the area. Factors such as crime rates, cleanliness, noise levels, and the presence of parks and green spaces can significantly contribute to the overall livability of a neighborhood. Engage in thorough research and go on local visits to gain a sense of the ambiance and determine if it aligns with your lifestyle and preferences.

Furthermore, it is important to take into account any future development plans in the vicinity. Investigate upcoming construction projects, zoning regulations, and urban planning initiatives. These factors can greatly impact the future value and growth potential of your dream residence. Understanding the long-term vision for the area will help you make an informed decision and avoid any potential surprises in the future.

Lastly, do not forget to consider the natural surroundings and climate of the location. Depending on your preferences, you may desire a house near the beach, a picturesque mountain view, or a serene countryside setting. Climate also plays a significant role in determining the comfort and suitability of a location. Research the average temperature, rainfall, and seasonal changes to ensure the climate aligns with your preferences.

| Factors to Consider for Your Dream House Location: |

|---|

| 1. Accessibility to transportation and amenities |

| 2. Characteristics of the neighborhood |

| 3. Future development plans in the area |

| 4. Natural surroundings and climate |

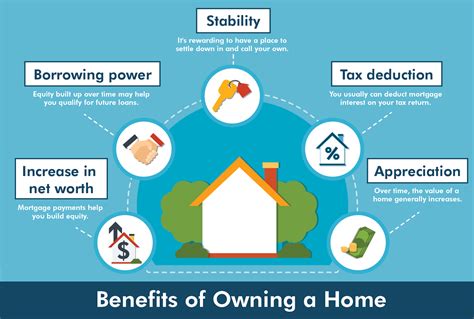

The Advantages of Homeownership: Establishing Equity and Developing a Long-Term Investment

When it comes to embarking on the journey of homeownership, there are numerous advantages that go beyond simply having a place to call your own. One of these benefits is the ability to build equity, which refers to the portion of your property's value that you actually own. This gradually increases as you make mortgage payments and the property's value appreciates over time. Unlike renting, where your monthly payments provide no return on investment, homeownership allows you to establish equity and create a valuable asset for the future.

By building equity, homeowners have the opportunity to develop a solid long-term investment. This investment not only provides financial security and stability but also serves as a tangible asset that can be utilized for various purposes. As the value of your property increases, so does your equity, thereby enhancing your overall net worth. Additionally, homeownership enables individuals to tap into the potential of leveraging their equity, allowing them to access funds through options such as home equity loans or refinancing, which can be utilized for renovations, educational expenses, or other significant financial goals.

- Stable Monthly Payments: Unlike renting, homeownership affords individuals the advantage of stable monthly payments. With a fixed-rate mortgage, your principal and interest payments remain consistent throughout the life of the loan, providing a predictable budgeting framework.

- Tax Benefits: Homeownership often comes with tax advantages, such as deductions for mortgage interest and property taxes. These deductions can help reduce your overall tax liability, resulting in potential cost savings.

- Control and Customization: Owning a home grants you the freedom to personalize and modify the space to suit your preferences. From painting the walls to renovating the kitchen, homeownership allows you to create a home that mirrors your unique style and needs.

- Sense of Community: Establishing roots in a neighborhood and becoming an active part of a community is another rewarding aspect of homeownership. Building relationships with neighbors and engaging in local events can enhance your overall sense of belonging and connection.

- Long-Term Wealth Accumulation: Over time, homeownership has proven to be a valuable vehicle for wealth accumulation. As property values appreciate, homeowners can leverage their equity to build additional wealth or use it as a stepping stone towards future real estate investments.

- Increased Stability: Having a stable and secure living environment is an essential benefit of homeownership. Unlike rented accommodations, homeowners have the peace of mind of long-term stability, allowing them to establish roots and create a sense of permanence for themselves and their families.

In conclusion, the advantages of homeownership extend far beyond the satisfaction of owning a property. Building equity and creating a long-term investment provide individuals with financial benefits, stability, and the ability to shape their living environment according to their desires. As you embark on your homeownership journey, consider the multiple advantages that come with this significant life milestone.

Mortgage Options: Exploring Different Loans to Achieve the Home of Your Dreams

When it comes to turning your dream of owning a beautiful, spacious residence into a reality, understanding the various mortgage options available is essential. By delving into the world of loans and exploring different financing avenues, you can make informed decisions that align with your individual goals and financial circumstances.

- Conventional Loans: These mortgage loans, offered by private lenders, typically require a down payment of at least 20% of the home's purchase price. They come with fixed or adjustable interest rates and are ideal for buyers with good credit scores.

- FHA Loans: Backed by the Federal Housing Administration, FHA loans offer flexible down payment options (as low as 3.5% of the purchase price) and lower credit score requirements. These loans are suitable for first-time buyers or individuals with limited savings.

- VA Loans: Exclusive to veterans, active-duty military personnel, and their eligible spouses, VA loans provide favorable terms and benefits such as zero down payment and no private mortgage insurance. These loans are administered by the Department of Veterans Affairs.

- USDA Loans: Designed for individuals purchasing homes in rural areas, USDA loans offer 100% financing and competitive interest rates. This loan program is administered by the United States Department of Agriculture.

- Jumbo Loans: Jumbo loans are suitable for those seeking financing beyond the conforming loan limits set by Fannie Mae and Freddie Mac. These loans often have stricter requirements and higher interest rates, but they enable borrowers to purchase higher-priced properties.

While these are just a few examples of the mortgage options available, it's important to consult with a qualified mortgage professional to determine the best loan for your specific needs. Factors such as credit score, income, down payment amount, and future plans will all influence the appropriateness of each loan type.

By understanding the various mortgage options, you can embark on your journey towards homeownership with confidence, turning your dream of owning a remarkable home into a concrete reality.

Choosing the Right Professional: Finding the Perfect Real Estate Agent for Your Needs

In the process of fulfilling your aspirations for homeownership, it's essential to understand the importance of working with a real estate agent who meets your specific requirements. The real estate agent you choose will play a significant role in guiding you through the process of finding and purchasing your dream home.

1. Researching Different Agents:

- Identify real estate agents who specialize in the type of property you are interested in, whether it's residential, commercial, or investment properties.

- Consider the agents' expertise and experience in your desired location.

- Read reviews, testimonials, and ratings from previous clients to gauge their professionalism and customer satisfaction levels.

2. Conducting Interviews:

- Prepare a list of questions to ask potential agents during the interview process.

- Inquire about their understanding of the local housing market, including recent trends and pricing.

- Ask about their negotiation skills and how they plan to leverage them to secure the best deal for you.

- Discuss their availability and communication style to ensure they align with your preferences.

3. Checking Credentials and Certifications:

- Verify the agents' credentials, licenses, and certifications to ensure they are qualified and legally authorized to represent you.

- Check if they are members of reputable real estate associations or organizations, as this demonstrates their commitment to the industry's ethical standards.

4. Assessing Compatibility:

- Consider the agent's personality and whether it aligns with your communication style and preferences.

- Evaluate their willingness to listen to your needs and understand your vision for your dream home.

- Assess their responsiveness and ability to address any concerns or questions promptly.

5. Asking for Referrals:

- Seek recommendations from friends, family, or colleagues who have recently gone through the home buying process with the help of a real estate agent.

- Ask for specific details about their experience, including the agent's strengths and areas for improvement.

- Consider scheduling consultations with agents who receive multiple positive referrals.

By following these steps and investing time and effort in finding the right real estate agent, you will increase the likelihood of a successful and fulfilling home buying experience. Remember, a knowledgeable and compatible agent will serve as your trusted guide throughout the journey, helping you find a property that not only meets your needs but also brings your homeownership dreams to life.

Home Inspections: Ensuring Your Ideal Property is in Optimal Condition

When embarking on the journey to homeownership, it's crucial to conduct a thorough inspection of your prospective residence to ensure that it meets your standards and remains a wise investment in the long run. In this section, we will delve into the significance of home inspections and the importance of thoroughly evaluating a property's condition before making the big decision to make it your own.

A home inspection is a vital step in the homebuying process, allowing you to obtain a comprehensive understanding of the property's overall condition. By engaging a certified home inspector, you can gain insights into any potential issues or risks that may exist within the home. These professionals scrutinize the property's various structural elements, including the foundation, roof, electrical system, plumbing, and more. Utilizing their expertise, they provide you with a detailed report highlighting any existing problems or future maintenance needs.

The results of a home inspection can significantly impact your decision-making process as a potential homeowner. Armed with the insights provided by the inspector, you can make an informed decision about whether to proceed with the purchase of the property. The findings may also be used as a negotiation tool, allowing you to request necessary repairs or adjustments from the seller before finalizing the deal.

A comprehensive home inspection report not only identifies existing issues but also provides valuable information about the anticipated lifespan of various components within the property. This knowledge allows you to budget for future repairs or renovations, ensuring that you can maintain your dream house in optimal condition over the years. It also helps you avoid any unpleasant surprises that may arise after moving in, allowing you to plan and prepare accordingly.

| Benefits of a Home Inspection: |

|---|

| 1. Ensures your dream property is structurally sound and safe. |

| 2. Provides an opportunity to negotiate repairs or adjustments with the seller. |

| 3. Helps you plan for future maintenance and renovations. |

| 4. Reduces the risk of unexpected expenses after purchase. |

In conclusion, conducting a thorough home inspection is an essential step in the process of purchasing your dream house. By engaging a certified inspector, you can gain valuable insights into the property's condition, allowing you to make informed decisions and avoid potential future issues. Remember, a well-inspected home is a solid foundation for fulfilling your homeownership dreams.

FAQ

What is the article about?

The article is about fulfilling your dreams of owning a big yellow house and provides a guide to achieve home ownership.

Why is the house described as "big" and "yellow"?

The house is described as "big" to emphasize its size and spaciousness, indicating the desire for a larger living space. The color "yellow" might be symbolic of happiness, warmth, and positivity, which are qualities people often associate with their dream homes.

What does the guide include?

The guide includes useful tips and steps to help individuals fulfill their dream of owning a big yellow house. It covers topics such as budgeting, saving for a down payment, finding the right neighborhood, working with real estate agents, and securing a mortgage.

Are there any specific recommendations for finding a big yellow house?

Yes, the article provides suggestions on how to find a big yellow house that matches your preferences. It advises exploring real estate listings, attending open houses, and reaching out to local real estate agents who can assist in the search process.