Creating a pathway towards financial independence and security is a pivotal step in modern society. In today's dynamic world, individuals are constantly seeking efficient and reliable methods to manage their hard-earned wealth. For those embarking on a quest for monetary stability, securing a trusted, robust, and accessible banking account is an essential foothold on this transformative voyage.

Within this comprehensive compendium, we will unravel the intricate process of establishing a personal financial sanctuary. As we traverse the labyrinthine terrain of banking procedures, we shall provide you with a step-by-step blueprint, leading you towards a myriad of opportunities for growth. Each chapter will bring forth a treasure trove of insights, tips, and tricks to navigate this terrain flawlessly, guaranteeing a seamless and fruitful journey towards opening your personal haven of financial success.

Embark on this tantalizing adventure as we explore the uncharted realms of the banking universe. Unlocking the secrets behind this seemingly arcane world will empower you with the knowledge required to make the best decisions for yourself and your future. With the guidance provided in this guide, you will maneuver through the intricacies of account acquisition and discover the hidden gems that lie within the financial realm. So, fasten your seatbelts and prepare to embark on a quest that will undoubtedly revolutionize the way you approach your monetary endeavors.

Benefits of Having a Personal Financial Account

In today's fast-paced and interconnected world, managing your personal finances efficiently is a crucial aspect of successful money management. Creating and maintaining a personal financial account offers numerous advantages that can help in achieving financial stability and security.

1. Economic Security: Having a personal financial account provides a secure and reliable place to store your hard-earned money. It ensures that your funds are protected and easily accessible whenever you need them, reducing the risk of loss or theft.

2. Convenience: With a personal financial account, you can enjoy the convenience of electronic banking services. Access to online banking, mobile apps, and ATM networks allows you to easily and quickly manage your money, transfer funds, pay bills, and monitor your transactions from anywhere at any time.

3. Financial Planning: Opening a personal financial account enables you to track your income, expenses, and savings, giving you a clearer picture of your financial situation. This knowledge empowers you to plan and budget effectively, identify areas for improvement, and work towards achieving your financial goals.

4. Building Credit History: Having a bank account is often a prerequisite for establishing a credit history. A positive credit history is essential for obtaining loans, credit cards, and other financial products. By consistently using and managing your account responsibly, you can build a strong credit rating over time.

5. Access to Financial Services: Banks offer a wide range of financial services tailored to meet various needs. By having a personal financial account, you gain access to services such as loans, mortgages, investment opportunities, and retirement planning advice, which can help you make informed decisions to grow and protect your wealth.

6. Safety of Funds: Banks are regulated financial institutions that adhere to strict security measures. Deposits made to a bank account are insured, providing an additional layer of protection. This ensures that your funds are safeguarded even if the bank faces financial difficulties.

Opening a personal financial account offers numerous benefits that can enhance your financial well-being and bring peace of mind. It is a crucial step towards effective money management and achieving your long-term financial goals.

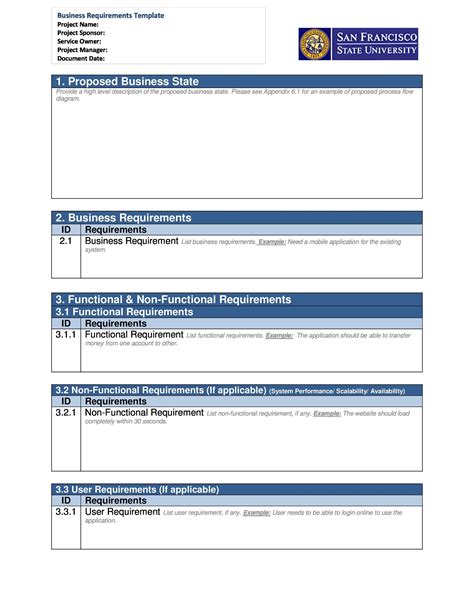

Preparing for Establishing an Account: Essential Steps to Take

Before embarking on the journey of setting up a financial account, it is crucial to go through a series of important preparations to ensure a smooth and hassle-free experience. This section aims to guide you through the necessary steps you need to take before proceeding with the account opening process.

| Step 1: | Researching Different Banks |

| Step 2: | Gathering the Required Documentation |

| Step 3: | Understanding Account Types and Features |

| Step 4: | Comparing Account Fees and Charges |

| Step 5: | Checking for Account Accessibility |

| Step 6: | Assessing Online and Mobile Banking Options |

Conducting thorough research on various banks is the first crucial step in preparing yourself to open a bank account. It is essential to compare different banks, considering factors such as their reputation, customer service, and the availability of branches and ATMs.

Gathering the necessary documentation is another vital aspect of the preparation process. Each bank may have specific requirements, but typically, you will need to provide identification documents, proof of address, and possibly income verification. Make sure to obtain copies of these documents in advance to expedite the account opening process.

Understanding the different account types and features offered by banks is essential to choose the one that best suits your financial needs. Take the time to analyze the benefits and limitations of various options like savings accounts, checking accounts, or certificates of deposit, considering factors such as interest rates, withdrawal limitations, and minimum balance requirements.

Comparing account fees and charges is also crucial to ensure that you select a bank account that aligns with your budget. Pay close attention to maintenance fees, transaction fees, ATM fees, and any other charges that may apply. Ideally, you would want to find a bank with minimal fees or options to waive them based on certain conditions.

Accessibility is another factor to consider when preparing to open an account. Evaluate the bank's accessibility by examining the number and location of their branches and ATMs. Think about whether the bank's network aligns with your daily routine and travel needs, ensuring convenient access to your funds.

Lastly, assess the online and mobile banking options offered by different banks. In today's digital age, having access to reliable and user-friendly digital banking services can greatly enhance your overall banking experience. Consider features such as online bill pay, mobile check deposit, and the availability of a mobile banking app.

Gather the Required Documents

In order to successfully open a bank account, you will need to gather the necessary documents. These documents are crucial for identification and verification purposes, enabling the bank to ensure the security and legality of the account opening process.

Start by collecting your identification documents, such as a valid passport or government-issued ID card. These documents will confirm your identity and provide the bank with the necessary information to establish your account.

Additionally, you will need to provide proof of address. This can be done by submitting utility bills, a rental agreement, or any other official documents that clearly display your current residential address.

Furthermore, financial institutions may require proof of income or employment. This could be in the form of recent pay stubs, bank statements, or employment contracts. These documents assist the bank in understanding your financial situation and determining your eligibility for certain account features or benefits.

Lastly, depending on the bank's policies and your specific circumstances, you may need to provide additional documents such as your Social Security Number (SSN), tax identification number, or any relevant legal documents.

Remember to double-check the specific requirements of the bank you are planning to open an account with, as requirements may vary. By gathering all the necessary documents in advance, you can streamline the account opening process and ensure a smooth experience.

Choosing the Right Type of Account

When embarking on your journey toward financial independence, one of the first steps is selecting the most suitable type of account to meet your unique needs. The choices may seem overwhelming at first, but fear not, as we are here to guide you toward making an informed decision.

Consider the various options available at financial institutions, each tailored to cater to specific financial objectives. Reflect on your short-term and long-term goals, evaluating whether you seek simplicity, flexibility, or growth.

An Everyday Checking Account could be the ideal choice for those seeking a straightforward and accessible banking experience. With its low fees and easy access to funds, it provides convenience for day-to-day transactions.

For individuals aiming to set money aside for future endeavors or unexpected expenses, a Savings Account offers a secure and interest-bearing solution. It allows you to accumulate funds while ensuring they remain easily accessible.

Certificate of Deposit (CD) Accounts present an attractive option for those looking to maximize their savings over a fixed period. These accounts offer higher interest rates in exchange for committing funds for a predetermined length of time, allowing for predictable growth.

Additionally, if you have specific financial goals, such as retirement or education, consider exploring Specialty Accounts that cater to those objectives. These accounts may offer unique benefits and features that align with your targeted savings plan.

Remember, selecting the right type of account is an important decision that plays a significant role in shaping your financial future. Take your time to research, compare, and assess your options, ensuring that you strive towards an account that will help you achieve your dreams.

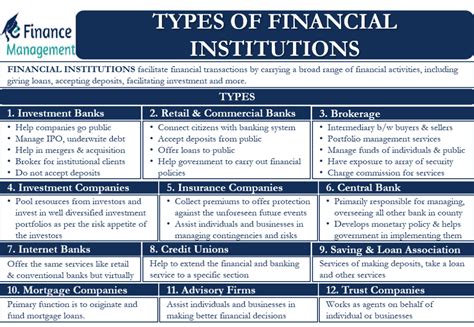

Exploring Different Financial Institutions

When embarking on the journey to open a new account, it is crucial to thoroughly research and evaluate various financial institutions before making a decision. This process involves exploring different banks, credit unions, and online banks to find the one that best suits your needs and preferences.

Begin by considering factors such as the bank's reputation, the range of services they offer, and any specific requirements they may have. This could include minimum balance requirements, fees, or additional features like mobile banking or rewards programs.

To aid in your research, make a list of potential banks and delve into their backgrounds. Look for information regarding their stability, customer satisfaction ratings, and any notable awards or recognition they may have received. Additionally, consider reading reviews and testimonials from current or previous customers to gain insights into their experiences.

- Financial Strength: Evaluate the financial strength of the bank to ensure its stability and security.

- Service Offerings: Take a close look at the range of services provided, including checking accounts, savings accounts, certificates of deposit, loans, and investment opportunities.

- Fees and Charges: Carefully review the fee structure associated with maintaining an account, including withdrawal fees, overdraft fees, and monthly maintenance fees.

- Location and Accessibility: Determine the bank's branch and ATM network to ensure convenient access to your funds.

- Customer Service: Assess the level of customer service offered by the bank, considering aspects such as response time, availability, and communication channels.

By thoroughly researching different financial institutions, you can choose the one that aligns with your financial goals, offers competitive services, and provides a positive banking experience.

Comparing Account Fees and Charges

When you are considering the best account to open, it is important to take into consideration the fees and charges associated with each option. Evaluating and comparing these fees can help you make an informed decision and choose the most suitable bank account for your needs.

Understanding the cost:

Before opening a bank account, it is crucial to understand the various fees and charges that may be applicable. These costs can vary from bank to bank and can significantly impact the overall banking experience.

Types of fees and charges:

Bank accounts may come with a variety of fees and charges, including monthly maintenance fees, ATM withdrawal fees, overdraft fees, transaction fees, and foreign exchange fees. It is important to be aware of these charges as they can add up over time and affect your money management.

Comparing the fees:

Take the time to carefully compare the fees and charges associated with different bank accounts. Look for any hidden fees or conditions that may apply. Consider how often you will be using certain services, such as ATM withdrawals or international transactions, and weigh the associated costs against the benefits provided.

Additional services:

While comparing account fees, don't forget to also evaluate the additional services and benefits that may be offered by each bank. Some banks may provide perks such as free online banking, mobile banking apps, or waived fees for maintaining a certain account balance. Considering these extras can help you make an even more informed decision.

Seeking advice:

If you are unsure about the fees and charges associated with opening a bank account, it is always a good idea to seek advice from a bank representative or financial advisor. They can guide you through the process of comparing different accounts and help you choose the one that best suits your financial goals.

Considering the Bank's Reputation

When embarking on the journey of opening a bank account, it is essential to carefully evaluate the reputation of the financial institution you are considering. As you entrust your finances to the bank, it is crucial to ensure that it has a solid reputation in the industry and among its customers.

- Research customer reviews and feedback: Begin by exploring online platforms, such as review websites and social media, where customers share their experiences with the bank. Look out for common themes in customer feedback, both positive and negative.

- Evaluate financial stability: Assess the bank's financial strength and stability by reviewing its annual reports, financial statements, and credit ratings. A financially stable bank is more likely to effectively manage your funds and provide reliable services.

- Consider bank's history and experience: Look into the bank's history and the number of years it has been operating. A longer-established bank often implies a higher level of experience and stability.

- Check for regulatory compliance: Ensure that the bank operates within legal boundaries and follows all necessary regulations. Verify if the bank is licensed and supervised by the appropriate financial authority.

- Seek recommendations: Reach out to friends, family, or colleagues who have experience with the bank you are considering. Their firsthand insights can provide valuable information and help you make an informed decision.

By considering the bank's reputation, you can gain a better understanding of its reliability, customer service quality, and trustworthiness. This evaluation will contribute to a successful and satisfying banking experience as you move forward with opening your account.

Making an Appointment: Essential Steps to Prepare for Your Banking Visit

When it comes to starting your journey towards financial empowerment, setting up an appointment with a financial institution is a crucial step. This section will provide you with an insightful guide on the important factors to consider and the necessary preparations to make before reaching out to schedule your appointment.

1. Research:

Prior to making an appointment with a bank, it is essential to conduct thorough research to identify the right financial institution that aligns with your specific needs and goals. Consider factors such as the bank's reputation, the range of services they offer, and their accessibility.

2. Assess Your Requirements:

Before contacting the bank, it is important to assess your personal requirements and the purpose of your visit. Whether you need to open a checking account, apply for a loan, or discuss investment options, having a clear idea of your goals will enable the bank representative to guide you effectively.

3. Gather Documentation:

One of the key aspects of making an appointment with a bank is ensuring that you have all the necessary documents in order. This typically includes identification proofs, proof of address, social security number, and any relevant financial documents like tax returns or pay stubs. Make sure to gather and organize these documents beforehand to avoid any delays or complications.

4. Choose an Optimal Time and Method:

It is advisable to select a convenient time and method of appointment scheduling. Banks usually offer various options such as phone appointments, online booking systems, or in-person visits. Consider your availability and preferences when making this decision.

5. Prepare Questions:

Prior to your appointment, make a list of questions or concerns you would like to discuss with the bank representative. By doing so, you ensure a productive and efficient meeting where all your doubts are addressed.

By following these steps, you will be well-prepared to make an appointment with a bank and maximize the benefits of the services they offer. Remember to keep your research thorough, provide all necessary documentation, and clearly communicate your requirements for a successful banking visit.

Preparing for Your Visit: What to Expect

When it comes to taking the next step in your financial journey, the act of visiting a bank can be an important milestone. As you embark on this venture, it is essential to be familiar with what to expect during your visit. Understanding the process and being prepared will help ensure a smooth and productive experience.

1. Document Requirements: Prior to your visit, it is advisable to gather all the necessary documents you may need to open a bank account. Common documents include identification such as a passport or driver's license, proof of address, and any additional identification documents that may be required.

2. Appointment Scheduling: To save time and avoid potential crowds, consider scheduling an appointment with the bank. This way, you can ensure that a dedicated bank representative will be available to assist you and answer any questions you may have.

3. Basic Banking Knowledge: Familiarizing yourself with basic banking terminology and services can be beneficial during your visit. Understanding terms such as savings account, checking account, debit card, and interest rates will enable you to make informed decisions when discussing your banking needs with the representative.

4. Arrival and Reception: Upon entering the bank, expect a warm welcome from the receptionist who will guide you to the appropriate area or assigned representative. They may also request you to provide some initial details about the purpose of your visit.

5. Meeting with a Bank Representative: During your meeting, the bank representative will guide you through the account opening process. They will explain the various account options available, the associated fees, and the required steps to complete the process. Don't hesitate to ask questions or seek clarification on any topic you do not fully understand.

6. Necessary Forms and Signatures: As part of the account opening process, you will be required to fill out various forms and provide your signature. The representative will assist you in completing the necessary paperwork and explain any legal obligations associated with opening an account.

7. Additional Services: In addition to opening a new bank account, you may also have the opportunity to inquire about additional services offered by the bank, such as loans, credit cards, or investment options. This could be an ideal time to explore these services and gather information for future consideration.

8. Next Steps: Before concluding your visit, ensure that you understand the next steps involved in the process. This may include receiving your account details, setting up online banking, or activating your debit card. Following these steps will allow you to start using your new bank account and reap its benefits.

By familiarizing yourself with these expectations and being adequately prepared, your visit to the bank will be a productive step towards achieving your financial goals.

Meeting with a Financial Institution Representative

A face-to-face meeting with a representative from a financial institution is an essential step towards realizing your aspiration. This interaction presents a unique opportunity to gain valuable insights, seek expert advice, and establish a personal connection.

Arranging a meeting with a bank professional serves as a crucial endeavor to facilitate the process of achieving your desired financial goals. During this meeting, you can navigate through the intricate pathways of banking services, clarify any doubts or concerns, and obtain tailored information based on your individual requirements.

Engaging with a bank representative allows you to discuss the various banking products and services available to you, such as different types of accounts, online banking options, and additional financial tools. The representative will guide you through the necessary documentation, requirements, and procedures, outlining the key steps involved in opening and managing an account.

Moreover, this encounter offers you the chance to express your specific needs and preferences, enabling the bank representative to better understand your unique financial objectives. They can provide personalized suggestions and recommendations accordingly, incorporating aspects such as interest rates, account fees, and any additional benefits or perks.

Building a relationship with a bank representative can also be advantageous for future interactions. By establishing trust and rapport, you can feel more confident in seeking further assistance or initiating discussions about other financial services, such as loans, investments, or credit cards, as your financial journey progresses.

Overall, organizing a meeting with a bank representative is an essential endeavor that grants you invaluable assistance, expert guidance, and the prospect of building a meaningful connection. Embrace this opportunity to effectively plan and embark on your financial endeavors with confidence and clarity!

Providing the Essential Details

In this section, we will explore the crucial information that you need to provide when opening a bank account. It is important to accurately furnish the necessary details to ensure a smooth and efficient account opening process.

Firstly, you will be required to provide your personal identification information, including your full name, date of birth, and current address. This information is essential for the bank to verify your identity and confirm your eligibility to open an account.

You will also need to provide your contact details, such as your phone number and email address. It is important to provide accurate contact information so that the bank can reach you for any account-related updates or queries.

Furthermore, you will have to disclose your employment details, including your occupation, employer's name, and your work address. This information helps the bank to assess your financial stability and determine the suitable type of account for your needs.

Additionally, you will need to provide your taxpayer identification number or social security number. This is necessary for the bank to comply with regulatory requirements and report your account activity to the relevant authorities.

Moreover, you may be asked to provide details about your current banking relationships, such as the names of other banks where you hold accounts. This information helps the bank evaluate your financial history and track any potential risks associated with your account.

Lastly, depending on the country and bank, you may need to provide additional documents such as proof of income, proof of address, or valid identification documents, like a passport or driver's license.

By providing accurate and complete information, you can ensure a hassle-free account opening experience and establish a strong foundation for your banking relationship.

Completing the Necessary Paperwork

When it comes to getting started with a new banking relationship, there are a few important forms and documents that you must sign. These documents serve as a legal agreement between you and the bank, outlining the terms and conditions of your account. In this section, we will provide you with a comprehensive overview of the required paperwork and guide you through the process of signing them.

First and foremost, you will be required to fill out an account application form. This form collects basic information about you, such as your full name, date of birth, address, and contact details. It also includes questions regarding your employment and financial situation, which helps the bank assess your eligibility for different banking services.

Additionally, you may need to sign a signature card. This card confirms your authorized signature for future reference and verifies your identity. It is essential to sign this card accurately and consistently with your legal signature, as it will be used to compare against future transactions to prevent fraud.

Furthermore, there may be specific agreements or contracts that you need to sign, depending on the type of account you are opening. For example, if you opt for a joint account, all authorized account holders will be required to sign a joint account agreement. This agreement outlines the rights and responsibilities of each account holder and ensures that all parties are in agreement regarding the use of the account.

In some cases, you may also need to provide supplementary documentation, such as proof of identification, proof of address, or a social security number. These documents are necessary to comply with regulatory requirements and verify your identity.

Before signing any documents, make sure to carefully read through the terms and conditions, as well as any other agreements presented to you. If you have any doubts or questions, do not hesitate to seek clarification from a bank representative. It is crucial to fully understand the commitments and obligations associated with opening a bank account before proceeding.

By completing and signing the necessary paperwork accurately and promptly, you will be one step closer to enjoying the benefits of having your own bank account and accessing a wide range of financial services tailored to your needs.

FAQ

What are the requirements for opening a bank account?

The requirements for opening a bank account may vary depending on the specific bank, but commonly required documents include identification proof such as passport or driver's license, proof of address, social security number or tax identification number, and sometimes a minimum deposit amount.

Can I open a bank account online?

Yes, many banks offer online account opening services. You can visit the bank's website and fill out the necessary forms, submit the required documents electronically, and complete the verification process to open a bank account online. However, certain banks may still require you to visit a branch for additional verification.

How long does it take to open a bank account?

The time it takes to open a bank account can vary based on several factors such as the bank's procedures, the completeness of your application, and the verification process. In some cases, you may be able to open a bank account within a few days, while in others, it may take up to a couple of weeks.

What are the different types of bank accounts I can open?

There are various types of bank accounts you can open, including checking accounts, savings accounts, certificates of deposit (CDs), money market accounts, and many more. Each type of account has its own features and benefits, so you can choose the one that best suits your needs and financial goals.

Do I need to deposit money to open a bank account?

Some banks require a minimum deposit amount to open certain types of accounts, such as a checking or savings account. However, there are also banks that offer no minimum deposit options. It's important to check with the specific bank you choose to know their requirements regarding the initial deposit.

What do I need to open a bank account?

To open a bank account, you typically need a valid ID, such as a passport or driver's license, proof of address, such as a utility bill or rental agreement, and sometimes a Social Security number or taxpayer identification number.

Can I open a bank account online?

Yes, many banks offer the option to open a bank account online. You can visit the bank's website, provide the required documents and information, and complete the application process digitally. However, some banks may still require you to visit a branch in person to finalize the account opening process.