In the realm of financial growth and prosperity, there lies a captivating domain that holds vast potential for those with an explorative spirit and a passion for venturing into new horizons. It is a realm where individuals seek to comprehend the dynamic nature of wealth creation and pave their own way towards prosperity.

Delving into the depths of the market, one discovers a treasure trove of possibilities known by many names: equities, stocks, or the ever-alluring world of shares. These elusive entities take their place on the stage of investment opportunities, presenting individuals with a unique avenue to grow their wealth and unlock the doors to a brighter future.

Within the confines of this ethereal landscape, lies a wealth of untapped potential waiting to be harnessed by those who possess the courage and foresight to embrace it. With a careful balance of calculated risk and strategic decision-making, individuals can navigate the complexities of the market, as it pulses with the energy of countless investors aiming for financial victory. Here, the old adage of risk and reward echoes resolutely, beckoning the bold and the prudent alike to join the ranks of those who dare to dream beyond the confines of conventional financial systems.

Understanding the Basics: What Are Shares and How Do They Work?

Exploring the fundamental concepts of investing, it is crucial to gain a comprehensive understanding of shares and their functionality. Shares, often referred to as stocks or equities, represent ownership in a company, granting individuals the opportunity to become shareholders and participate in its success.

Shares symbolize a division of a company's ownership and are issued to investors in exchange for their capital. By purchasing shares, individuals essentially acquire a stake in the company, entitling them to a portion of its profits and assets. The value of shares can fluctuate based on various factors, including market conditions, financial performance, and investor sentiment.

Ownership through shares grants investors certain rights and privileges within a company. Shareholders typically have the power to vote on important corporate decisions, such as the election of board members and approval of major business strategies. Additionally, shareholders may receive dividends, which are a distribution of a company's earnings, providing additional returns on their investment.

The mechanics of share ownership involve buying and selling shares through financial markets, such as stock exchanges. Investors can choose to hold shares for the long term, believing in the company's growth potential, or engage in short-term trading to capitalize on price fluctuations. Furthermore, shares can be categorized into different types, such as common shares and preferred shares, each offering distinct rights and risks for investors.

Understanding the basics of shares and how they work lays the foundation for successful and informed investment decisions. By exploring the intricacies of share ownership, individuals can navigate the world of investing with confidence and potential for long-term financial growth.

Getting Started with Investing in Shares: A Beginner's Guide to Building a Diversified Portfolio

Are you eager to learn how to make your money work for you through investing in shares? This beginner's guide will provide you with valuable insights on how to build a diverse portfolio that can help you maximize potential returns and minimize risk.

| Table of Contents: |

| 1. Understanding Shares and the Stock Market |

| 2. Benefits of Investing in Shares |

| 3. Determining Your Investment Goals |

| 4. Assessing Risk Tolerance |

| 5. Building a Diversified Portfolio |

| 6. Choosing the Right Stocks |

| 7. Monitoring and Reviewing Your Portfolio |

| 8. Importance of Regular Investing |

| 9. Seeking Professional Advice |

Before diving into the world of investment, it is crucial to understand the fundamentals of shares and the stock market. This knowledge will serve as the foundation for your investing journey. Once you grasp the basics, you can explore the benefits of investing in shares and how they can contribute to your financial goals.

When starting your investment journey, it is essential to determine your investment goals. Whether you are looking to save for retirement, buy a house, or fund your child's education, defining clear objectives will help you make informed investment decisions. Additionally, assessing your risk tolerance is crucial as it will determine the level of risk you are comfortable with, ultimately influencing your investment strategy.

One of the key principles in a successful investment strategy is building a diversified portfolio. Diversification involves investing in a variety of shares across different industries and geographical locations. This approach helps spread risk and reduce the impact of any individual stock performing poorly. It is important to understand how to achieve diversification effectively.

Choosing the right stocks is another critical aspect to consider. This involves conducting thorough research on companies, analyzing financial statements, and staying informed about market trends. By selecting stocks that align with your investment goals and exhibit growth potential, you can increase the likelihood of achieving desired returns.

Monitoring and reviewing your portfolio regularly is essential to ensure it remains in line with your investment objectives. This can involve adjusting your holdings based on changing market conditions and evaluating the performance of individual stocks. Regular investing is also pivotal as it enables you to capitalize on market trends and potentially benefit from the compounding effect over time.

While conducting independent research is valuable, seeking professional advice from financial advisors can provide additional insights and expertise. A qualified advisor can help you navigate the complexities of the stock market, provide personalized recommendations, and assist in creating a well-rounded investment plan.

By following this beginner's guide and implementing the principles outlined, you can embark on your investment journey with confidence and work towards building a diversified portfolio that unlocks potential returns in the exciting world of shares.

Exploring Different Types of Shares: Common, Preferred, and Promoter Shares

In this section, we will delve into the various types of shares available in the investment market. Understanding the differences between common, preferred, and promoter shares is essential for any aspiring investor seeking to diversify their investment portfolio.

- Common Shares: These shares represent the ownership in a company and give the shareholder voting rights in corporate matters. Common shares often provide potential for higher returns in the form of capital appreciation, but the risk associated with them is also relatively high.

- Preferred Shares: Unlike common shares, preferred shares do not typically carry voting rights. However, they offer a fixed dividend payment, providing investors with a more stable income stream. Preferred shares are considered less risky compared to common shares due to their priority in receiving dividends and assets in the event of liquidation.

- Promoter Shares: Promoter shares are a unique type of equity that is usually held by the founders or initial investors of a company. These shares often come with additional rights and benefits, such as higher voting power or preferential treatment in the distribution of profits. Promoter shares play a crucial role in shaping the direction and decision-making of the company.

By exploring the distinctions between common, preferred, and promoter shares, investors can make informed decisions about their investment strategies. It is essential to weigh the potential returns, risks, and benefits associated with each type of share before allocating your funds in the market.

Analyzing Stock Market Trends: Identifying Potential Investment Opportunities

Understanding how to analyze stock market trends is essential for identifying potential investment opportunities. By examining the patterns and behavior of stocks, investors can make more informed decisions and maximize their returns.

- Historical data analysis: One way to analyze stock market trends is by studying historical data. Looking at the past performance of a stock can provide insights into its future potential. By examining factors such as price movements, trading volume, and market trends over a specific period, investors can identify patterns and make predictions.

- Fundamental analysis: Another method for evaluating stocks is through fundamental analysis. This approach involves assessing a company's financial health, including its earnings, revenues, assets, and liabilities. By examining key financial ratios and comparing them to industry benchmarks, investors can determine the intrinsic value of a stock and identify undervalued or overvalued opportunities.

- Technical analysis: Technical analysis involves studying stock price charts and using various tools and indicators to identify trends and patterns. This approach assumes that historical price and volume data can predict future price movements. Common techniques include trend lines, moving averages, and relative strength indicators.

- Market news and industry analysis: Staying informed about market news and industry developments is crucial for identifying potential investment opportunities. By following relevant news sources and conducting thorough industry analysis, investors can gain insights into emerging trends, new technologies, regulatory changes, and other factors that can impact stock prices.

By combining these analytical approaches, investors can develop a well-rounded understanding of stock market trends and identify potential investment opportunities. It is important to note that investing in the stock market always carries risks, and thorough research and analysis are essential for making informed decisions.

Risks and Rewards: Assessing the Potential Returns and Pitfalls of Share Investments

When considering venturing into the world of share investments, it is crucial to evaluate the potential returns and pitfalls that come with it. This section aims to explore the exciting opportunities as well as the inherent risks that await investors in the realm of shares.

Assessing Potential Returns:

Investing in shares can offer the possibility of significant returns on investment. By purchasing shares in a company, individuals become partial owners and have the potential to benefit from the company's success. Shareholders can earn returns through capital appreciation, as the value of shares may increase over time due to company growth or market demand. Additionally, dividends are often distributed to shareholders, providing a regular income stream.

Evaluating Risks:

While the potential for lucrative returns can be enticing, share investments come with inherent risks that need to be carefully evaluated. Market volatility can lead to fluctuations in share prices, potentially resulting in a loss of investment. Economic conditions, industry-specific factors, and company performance can also impact share values. It is crucial to conduct thorough research and analysis to assess the risks associated with specific shares and make informed investment decisions.

Pitfalls to Watch Out For:

Investing in shares entails risks beyond mere price fluctuations. Lack of diversification in a portfolio can expose investors to a higher degree of risk, as the performance of a single company can significantly impact overall returns. Additionally, market timing is a common pitfall, as trying to predict the perfect moment to buy or sell shares can be challenging and often leads to suboptimal outcomes. It is essential to have a long-term investment strategy and a diversified portfolio that aligns with individual financial goals and risk tolerance.

Conclusion:

Assessing the potential returns and pitfalls of share investments is crucial for individuals seeking to enter the market. By carefully evaluating the potential rewards and understanding the associated risks, investors can make informed decisions to maximize their chances of success. Ultimately, share investments can provide opportunities for wealth accumulation but require diligence, research, and a long-term perspective to navigate the dynamic landscape of the stock market.

The Role of Technology: How Online Trading Platforms Have Revolutionized Share Investing

The rapid advancement of technology has brought about significant changes in the way individuals approach investment opportunities and, more specifically, share investing. Online trading platforms have emerged as a revolutionary tool that has transformed the landscape of the financial market. These platforms provide a seamless and convenient way for investors to access a wide range of investment options, analyze market trends, and execute trades.

Efficiency and Accessibility

One of the primary benefits of online trading platforms is the efficiency they offer to investors. Through these platforms, individuals can easily monitor their investments in real-time, access detailed information about stocks, and make well-informed decisions based on market analysis. The use of advanced trading tools and algorithms has made the process of buying and selling shares quick and hassle-free, eliminating the need for investors to rely on traditional brokers or intermediaries.

Additionally, online trading platforms have significantly enhanced the accessibility of share investing. Unlike traditional methods, investors can now access global markets and trade shares from any location, at any time. The elimination of physical barriers has democratized investment opportunities, allowing individuals from all walks of life to participate in share trading and potentially benefit from market fluctuations.

Empowering Investors through Education

Online trading platforms not only provide a means to access investment opportunities but also empower investors through educational resources and tools. These platforms offer comprehensive market research and analysis, tutorials, webinars, and other learning materials to help investors improve their understanding of share investing. The availability of such resources fosters a culture of informed decision-making and encourages cautious yet strategic investment strategies.

Furthermore, online trading platforms often feature interactive communities and forums, allowing investors to connect with like-minded individuals and share experiences, insights, and tips. This collaborative environment promotes knowledge sharing and provides a support network for investors, particularly those who are new to share investing.

The Future of Share Investing

The role of technology in the financial industry will undoubtedly continue to evolve, shaping the future of share investing. Online trading platforms have already made investing more accessible, efficient, and educational. As technology advances further, we can expect to see continued innovation and the introduction of new features and tools that will further streamline the investment process and enhance the overall investor experience.

FAQ

What is the article about?

The article is about unlocking investment opportunities through shares.

Why should I consider investing in shares?

Investing in shares can provide an opportunity for financial growth and can be a way to diversify your investment portfolio.

What are the potential risks of investing in shares?

There are several potential risks when investing in shares, such as market volatility, company-specific risks, and the possibility of losing money.

How can I determine which shares to invest in?

Determining which shares to invest in requires thorough research and analysis of various factors, including the company's financial performance, industry trends, and market conditions.

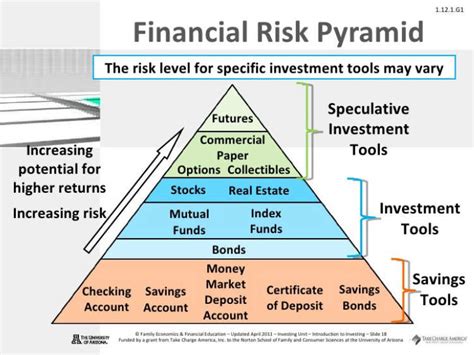

Are there any alternative investment options to consider besides shares?

Yes, besides shares, there are alternative investment options such as bonds, real estate, mutual funds, and commodities that you can consider.