Imagine a tool that shatters the barriers of traditional banking, opening up a realm of possibilities previously unheard of. This financial embodiment facilitates seamless transactions, empowers individuals, and kindles the flame of financial freedom. Introducing a revolutionary concept that epitomizes convenience and security – the gateway to your monetary aspirations.

Embrace this majestic invention that serves as a conduit for your financial dreams to materialize: a compact and versatile means of accessing your hard-earned wealth. This multifaceted instrument is more than merely a plastic card, for it carries within itself the power to grant you access to a multitude of resources, empowering you to take control of your destiny and navigate through the intricate world of finance with confidence.

Envision a key that opens doors to a world of opportunities, allowing you to channel your inner strengths and pursue your aspirations. Within the depths of this unassuming card lies the potential to venture into uncharted territories, where limitations are non-existent, and boundaries are shattered. With the wave of this magical wand, financial avenues once considered inaccessible become accessible, and the freedom to explore, create, and prosper becomes reality.

Embracing this technological marvel grants you the means to redefine your identity, transcending monetary limitations and forging a new path towards financial empowerment. Seamlessly integrating into your daily routine, this portable companion steadily ushers you into a realm where possibilities are endless and the power of financial independence lies within your grasp. Welcome this undeniable transformation and embark on a journey towards a life where your dreams, ambitions, and desires no longer remain distant aspirations, but rather tangible footholds on the path towards unwavering prosperity.

The Power of Access: Exploring the Advantages of ATM Cards

As we navigate the realm of financial transactions and explore avenues that pave the way towards a prosperous future, there lies a key component that unlocks a world of possibilities - the ATM card. Revealing a gateway to convenience and financial empowerment, the benefits of utilizing an ATM card extend far beyond the boundaries of traditional banking.

Embracing the power of access, an ATM card provides individuals with the ability to effortlessly manage their finances in a manner that is both secure and efficient. With a simple swipe or insertion, it grants instant access to funds, allowing for seamless transactions and cash withdrawals at various locations worldwide.

One of the significant advantages of utilizing an ATM card is the convenience it offers. Whether one finds themselves in a bustling city or a remote village, access to financial resources becomes a tangible reality. Gone are the days of relying solely on physical cash or needing to locate a specific bank branch to complete transactions. With an ATM card in hand, one possesses the flexibility to seamlessly navigate the financial landscape, regardless of location or time constraints.

Beyond convenience, an ATM card provides a layer of security to its users. Gone are the worries of carrying a substantial amount of cash or the fear of losing valuable funds. By allowing authenticated access only to the cardholder, the risk of theft or misplacement is significantly minimized. Furthermore, the ability to set PIN numbers and restrict certain transactions adds an additional level of protection, ensuring peace of mind while conducting financial transactions.

Additionally, an ATM card serves as a gateway to a myriad of financial services. Online banking, mobile applications, and digital wallets become easily accessible, allowing individuals to monitor and manage their accounts with ease. The integration of technology with financial literacy empowers users to take control of their financial well-being, enhancing their understanding of personal finance and bolstering their ability to make informed decisions.

In conclusion, the power of access bestowed by an ATM card opens doors to convenience, security, and a world of financial services. The ability to effortlessly transact, manage funds, and stay in control of one's financial destiny offers a sense of empowerment and freedom. By embracing the advantages of an ATM card, individuals can unlock a realm of potential, paving the way towards a brighter financial future.

From Cash-Only to Cashless: How Debit Cards are Revolutionizing Commerce

In the ever-evolving world of commerce, the way we make payments has drastically changed. Gone are the days where cash was king, as we are now witnessing a paradigm shift towards cashless transactions. At the forefront of this revolution are debit cards, which have emerged as a convenient and secure alternative to traditional cash payments.

Embracing electronic payment methods

The rise of debit cards signals a shift towards embracing electronic payment methods as the primary mode of commerce. No longer limited by the need to carry cash, individuals can now effortlessly make purchases at various establishments with the simple swipe or tap of a card. This convenience has not only transformed the way we shop but has also paved the way for new possibilities in the digital age.

Enhancing security and peace of mind

Debit cards provide an enhanced level of security compared to carrying cash. With features such as PIN codes, chip technology, and contactless payments, users can have peace of mind knowing that their financial transactions are protected. This technology-driven approach minimizes the risk of theft or loss and greatly improves the overall safety of transactions.

Driving financial inclusion

Debit cards have played a significant role in driving financial inclusion, particularly for individuals who were previously excluded from traditional banking systems. With the ability to open a bank account and obtain a debit card, even individuals without a credit history or formal employment can now access various financial services. This increased accessibility empowers individuals to participate fully in the economy and take control of their financial well-being.

Enabling seamless online transactions

As e-commerce continues to flourish, debit cards have become indispensable for making online transactions. Whether it's purchasing goods from online retailers or paying for subscriptions and services, having a debit card allows individuals to navigate the digital landscape with ease. The integration of debit card payment options on websites and mobile applications has made the online shopping experience more convenient and accessible to all.

In conclusion, debit cards have transformed commerce by shifting us from a cash-only society to a cashless one. With enhanced convenience, security, and inclusivity, debit cards have revolutionized the way we make payments and conduct financial transactions, opening new doors for economic empowerment and participation in the digital age.

Ensuring Safety: Exploring the Protective Features of ATM Cards

In this section, we delve into the crucial aspect of security when it comes to financial transactions using ATM cards. Understanding the various safety measures and features implemented in these cards is essential for safeguarding our financial well-being.

1. Fraud Prevention: ATM cards are equipped with advanced fraud prevention mechanisms to protect against unauthorized access and fraudulent activities. These include embedded microchips, unique PIN codes, and encryption technologies.

2. EMV Technology: One significant safety feature of ATM cards is the implementation of EMV (Europay, Mastercard, and Visa) technology. This chip-enabled feature adds an extra layer of protection by generating a unique transaction code for each purchase, making it difficult for fraudsters to replicate or tamper with card information.

3. One-Time Passwords: Another safety measure is the use of one-time passwords (OTPs) that are sent to the cardholder's registered mobile number when conducting online transactions. These passwords expire after a single use, ensuring enhanced security and preventing unauthorized access.

4. Contactless Payment Technology: Many ATM cards now feature contactless payment technology, enabling users to make transactions by simply tapping their card or mobile device on a compatible terminal. This technology utilizes Near Field Communication (NFC), which ensures secure and fast transactions while minimizing the risk of card information being compromised.

5. Monitoring and Notification Services: Financial institutions offer monitoring and notification services that alert cardholders immediately of any suspicious activities detected on their accounts. This enables prompt action to be taken to prevent financial losses and maintain cardholder security.

6. Zero Liability Protection: Most ATM cards offer zero liability protection, which ensures that cardholders are not held responsible for any unauthorized transactions, provided they report the incident promptly. This offers individuals peace of mind knowing that their finances are safeguarded in the event of theft or fraudulent activity.

7. Secure PIN Entry: ATM cards require a personal identification number (PIN) to access funds or conduct transactions. It is crucial for cardholders to be diligent in protecting their PINs, ensuring they are not shared with anyone and choosing strong, unique combinations that are not easily guessable.

Overall, ATM cards incorporate a range of safety features to protect users from potential financial risks. Understanding and utilizing these safety features effectively is essential for maintaining the security and integrity of our financial transactions.

Managing Your Finances: Tips for Smart Use of Your Bank Card

As you traverse the realm of financial independence, it becomes crucial to navigate your funds wisely. One of the primary tools at your disposal is the convenience of an automated teller machine (ATM) card. To make the most of this technological marvel, it is imperative to grasp effective strategies for managing your finances through astute usage of your bank card.

1. Monitor Your Transactions: Stay vigilant by regularly reviewing your bank statements and transaction history. This practice ensures that you are aware of every purchase, withdrawal, or deposit made using your card, allowing you to identify any discrepancies or suspicious activity promptly.

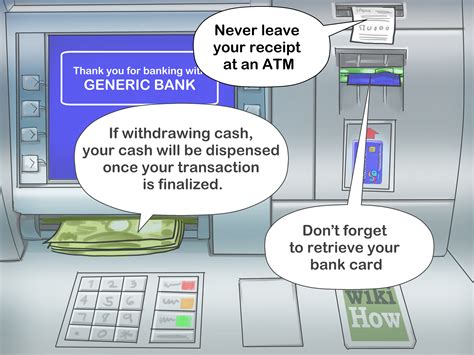

2. Exercise Caution at ATMs: When using an ATM, be aware of your surroundings and shield your PIN number from prying eyes. Opt for well-lit, secure locations, and avoid ATMs that appear tampered with or in poor condition. Regularly check your account balance to discourage any unauthorized access.

3. Set Realistic Spending Limits: Establish a budget and adhere to it. Determine an appropriate amount to withdraw from your account based on your financial goals and obligations. By maintaining discipline in your spending habits, you avoid the pitfalls of excessive debt and financial strain.

4. Embrace Technology: Explore the various digital banking features available, such as mobile apps and online banking platforms. These tools empower you to conveniently track your transactions, pay bills, and set up alerts for low balances or unusual activity.

5. Minimize Fees: While using your ATM card, select ATMs affiliated with your bank to avoid unnecessary fees. Prioritizing the use of in-network ATMs reduces transaction charges and can save you a significant amount of money over time.

6. Keep Your Card Safe: Safeguard your ATM card and treat it as a valuable possession. Ensure it is not exposed to extreme temperatures, keep it separate from unsecured items, and promptly report any lost or stolen cards to your bank.

By practicing these tips for the wise use of your bank card, you can confidently manage your finances and lay the foundation for a prosperous and financially stable future.

Beyond Cash Withdrawals: Exploring the Many Functions of ATM Cards

In this section, we delve into the myriad possibilities and features offered by modern ATM cards, extending far beyond their traditional role as simply cash withdrawal tools. With the advancements in technology and the digitalization of financial services, ATM cards have evolved to serve as multi-functional instruments that empower individuals to manage their finances conveniently and efficiently.

One notable function of ATM cards is their ability to facilitate electronic fund transfers. With just a few simple steps, individuals can transfer funds between their accounts, whether it be from a checking to a savings account or vice versa. This feature eliminates the need for physical checks or in-person transactions, providing a convenient and secure way to move money, especially in today's increasingly digital world.

Additionally, ATM cards serve as gateways to online banking. Through secure platforms, individuals can access their accounts, view transaction histories, and monitor their balances, empowering them with real-time insights into their financial standing. The convenience of online banking allows individuals to conveniently manage their funds, whether it's making bill payments, monitoring expenses, or setting up automatic transfers. With the ease of access provided by ATM cards, individuals can take control of their financial well-being anytime, anywhere.

Moreover, ATM cards often come equipped with contactless payment capabilities. This feature enables individuals to make purchases at various point-of-sale terminals without the need for physical cash or cards. With just a simple tap, individuals can complete transactions swiftly and securely, enhancing convenience and reducing the risk of theft or loss. Contactless payments have become increasingly prevalent in today's society, further expanding the functionality of ATM cards beyond traditional cash withdrawals.

Additionally, some ATM cards offer rewards programs and cashback options, providing individuals with incentives to use their cards for everyday purchases. These programs allow individuals to earn points or cashback on eligible transactions, which can then be redeemed for various rewards or applied towards future purchases. This feature adds an extra layer of value to ATM cards, making them even more advantageous to individuals seeking to maximize their financial benefits.

Overall, today's ATM cards have evolved into versatile tools that offer a range of functions beyond cash withdrawals. From facilitating electronic fund transfers to providing access to online banking platforms and enabling contactless payments, ATM cards empower individuals with the convenience and flexibility to manage their finances effectively. By embracing the many capabilities of ATM cards, individuals can unlock new opportunities for financial empowerment and enhance their overall financial well-being.

Breaking Away from Traditional Banking Systems: The Empowering Influence of ATM Cards

In a world where financial independence is increasingly sought after, individuals are looking for innovative ways to break free from the limitations of traditional banking systems. One such empowering tool that has gained widespread popularity is the ATM card. With its ability to provide quick and convenient access to funds, ATM cards have revolutionized the way individuals can manage their finances.

Revolutionizing Accessibility: The advent of ATM cards has brought unprecedented convenience to individuals across the globe. Gone are the days when one had to wait in long queues at banks or adhere to limited banking hours. Now, anyone with an ATM card can access their funds at any time, day or night, from a vast network of automated teller machines. This newfound accessibility empowers individuals by allowing them to take control of their finances on their own terms.

Empowering Financial Autonomy: ATM cards have given individuals the power to manage their finances independently. Gone are the barriers of relying solely on physical bank branches or personal interactions. With an ATM card, individuals can effortlessly check their account balances, withdraw cash, deposit funds, and even transfer money between accounts, all with the simple swipe or insertion of a card. This financial autonomy allows individuals to make timely and informed decisions about their money, empowering them to take charge of their financial future.

Enhancing Security Measures: While traditional banking systems often come with concerns over the safety of one's funds, ATM cards have introduced enhanced security measures to help ease these worries. The use of personalized PINs, encrypted data transfer, and security cameras at ATM locations has significantly reduced the risks associated with carrying cash or conducting transactions in person. This heightened security ensures that individuals can go about their daily financial activities with peace of mind, knowing that their funds are protected.

Encouraging Financial Literacy: The widespread use of ATM cards has inadvertently contributed to the promotion of financial literacy. With easy access to account information and transaction records, individuals are encouraged to monitor their spending habits and make sound financial decisions. By encouraging individuals to take an active role in managing their money, ATM cards foster financial responsibility and awareness, ultimately empowering individuals to build a stronger financial foundation.

In conclusion, ATM cards have fundamentally changed the way individuals interact with the banking system, empowering them with newfound accessibility, financial autonomy, enhanced security measures, and a greater understanding of personal finances. As technology continues to advance, the influence of ATM cards will likely grow, further unlocking financial freedom for individuals worldwide.

The Future of Banking: How Debit Cards are Shaping the Digital Economy

In today's digital age, the evolution of banking is fundamentally changing the way people manage their finances. Debit cards, acting as a gateway to the digital economy, play a crucial role in shaping the future of banking by revolutionizing the way financial transactions are conducted. This section explores the impact of debit cards on the digital economy and its potential role in transforming the way we bank.

1. Embracing Digital Transactions:

- Debit cards have become an indispensable tool for individuals and businesses alike, allowing for seamless digital transactions without the need for physical currency.

- As technology advances, we are witnessing a shift towards a cashless society where debit cards are playing a pivotal role in driving the digital economy.

- With the rise of online shopping, contactless payments, and mobile banking apps, debit cards provide individuals with greater convenience and accessibility to their funds.

2. Enhancing Security Measures:

- Debit cards are equipped with advanced security features that protect consumers against fraudulent activities and unauthorized transactions.

- The integration of EMV chips and biometric authentication methods, such as fingerprint or facial recognition, adds an extra layer of security to ensure the safety of financial transactions.

- By utilizing these security measures, debit cards are instilling trust and confidence in consumers, making them a preferred choice in the digital economy.

3. Facilitating Financial Inclusion:

- Debit cards are playing a vital role in promoting financial inclusion, allowing individuals who traditionally faced barriers to banking services to participate in the digital economy.

- By providing access to digital payment systems and online banking platforms, debit cards enable underserved populations to manage their finances, make purchases, and engage in e-commerce activities.

- This inclusivity fosters economic growth, empowers individuals, and stimulates the overall development of the digital economy.

4. Driving Innovation:

- The ubiquity of debit cards has opened up avenues for innovation in the digital economy, inspiring the creation of new financial products and services.

- Financial technology (fintech) companies are leveraging debit cards as a foundation to develop innovative solutions such as budgeting apps, peer-to-peer payment platforms, and personalized financial management tools.

- Through collaboration between banks, businesses, and fintech companies, debit cards are reshaping the landscape of the digital economy by facilitating novel ways of managing money.

In conclusion, the future of banking lies within the transformative power of debit cards in shaping the digital economy. As technology continues to evolve, debit cards are propelling us towards a cashless society, enhancing security measures, promoting financial inclusion, and driving innovation. Embracing this future requires recognizing the profound impact debit cards have on the way we bank and harnessing their potential to unlock new opportunities in the digital era.

Expanding Opportunities: Enhancing Financial Accessibilit

In this section, we explore the ways in which the accessibility of financial services is being revolutionized through the proliferation of ATM cards. By expanding the reach and convenience of banking services, these cards are enabling individuals from all walks of life to actively participate in the formal financial system, regardless of their geographical location or socioeconomic background.

The advent of ATM cards has brought about a paradigm shift in the banking industry by bridging the gap between traditional brick-and-mortar banks and underserved populations. Previously, many individuals lacked access to banks due to various factors such as distance, lack of identification, or limited operating hours. However, the emergence of ATM cards has allowed financial institutions to establish a widespread presence, making banking services readily available to even the most remote areas.

By providing ATM cards to individuals, financial institutions are empowering them with the ability to conduct a wide range of transactions independently. Whether it be cash withdrawals, fund transfers, or balance inquiries, these cards provide a secure and convenient means of accessing and managing finances. This newfound autonomy is particularly crucial for individuals living in areas without access to traditional banking infrastructure, as it allows them to overcome barriers and take control of their financial lives.

Moreover, ATM cards are not just limited to physical banks; they are increasingly being integrated into various digital platforms to further enhance financial inclusion. Through the use of mobile banking applications and online platforms, individuals can easily access their accounts, make payments, and carry out transactions anytime, anywhere. This seamless integration of technology and financial services has opened up a new world of opportunities for individuals who were previously excluded from the formal financial system.

In summary, the widespread availability of ATM cards has significantly contributed to increasing financial inclusion by expanding access to banking services and empowering individuals with greater financial autonomy. These cards have emerged as a vital tool in promoting economic inclusion, bridging the gap between the underserved and the formal financial system. As we move towards a more inclusive future, it is essential to recognize the immense potential of ATM cards in unlocking new opportunities and empowering individuals to achieve their financial goals.

Empowering Individuals through Financial Knowledge: Promoting Financial Literacy with ATM Cards

In this section, we will explore the significant role of ATM cards in enhancing financial literacy and educating consumers on effective money management. By providing individuals with access to electronic transactions, ATM cards serve as valuable tools for promoting financial empowerment and responsibility.

With the rise of digital banking and the increasing reliance on electronic transactions, it is essential for consumers to have a comprehensive understanding of money management principles. Financial literacy equips individuals with the skills and knowledge necessary to make informed decisions about spending, budgeting, saving, and investing.

ATM cards play a crucial role in promoting financial literacy by providing a tangible representation of personal finances and facilitating convenient access to financial resources. Through the utilization of an ATM card, consumers can gain practical experience in tracking expenses, monitoring account balances, and making informed financial decisions.

Moreover, ATM cards serve as educational tools that encourage individuals to cultivate responsible financial habits. The act of using an ATM card instills a sense of ownership and accountability, as individuals become more mindful of their financial transactions and the impact of their financial choices.

Financial literacy is not only about understanding the mechanics of using an ATM card; it encompasses a broader spectrum of financial knowledge, including concepts like budgeting, debt management, and investment strategies. By incorporating financial education into the use of ATM cards, individuals can develop a holistic understanding of their money and improve their overall financial well-being.

In conclusion, ATM cards hold immense potential as vehicles for financial literacy. With the proper guidance and education, individuals can unlock the power of ATM cards to enhance their financial knowledge, cultivate responsible financial habits, and ultimately achieve a more secure and prosperous future.

Unleashing Economic Progress: How Debit Cards Foster Entrepreneurial Spirit and Foster Innovation

In today's modern economy, the rise of debit cards has revolutionized the way people conduct financial transactions. These innovative payment tools have become a catalyst for economic growth, driving entrepreneurship and fostering innovation.

Debit cards, with their heightened convenience and accessibility, empower individuals to venture into new business endeavors with confidence and ease. By providing a secure and efficient means of conducting transactions, debit cards free entrepreneurs from the constraints of traditional financial systems. This newfound financial freedom enables aspiring business owners to pursue their innovative ideas while navigating the challenges of funding and liquidity.

The ability to securely transfer funds electronically through debit cards also plays a vital role in nurturing entrepreneurship and innovation. This seamless method of payment facilitates the rapid exchange of capital, reducing friction and allowing businesses to respond swiftly to market demands. Entrepreneurs can now efficiently invest in research and development, hire talented individuals, and acquire necessary resources, strengthening their ability to introduce groundbreaking products and services.

Moreover, debit cards promote financial inclusion by providing affordable and accessible banking solutions to underserved populations. This democratization of financial tools empowers individuals from all walks of life, including those in rural or remote areas, to participate in economic activities and unlock their entrepreneurial potential. By eliminating barriers to entry, debit cards contribute to a more dynamic and diverse business landscape, fostering competition and driving innovation across industries.

Furthermore, the real-time transaction data generated through debit card usage offers valuable insights to entrepreneurs and policymakers, enabling them to make informed decisions and shape economic policies. This data-driven approach not only enhances business operations but also facilitates targeted interventions that promote inclusive growth and sustain economic development.

In summary, debit cards serve as the cornerstone of economic progress by fueling entrepreneurship and fostering innovation. Their convenience, security, and accessibility empower individuals to pursue their entrepreneurial dreams while contributing to economic growth and prosperity. As we continue to embrace and leverage the power of debit cards, we unlock a world of opportunities for individuals and societies alike, propelling us towards a brighter and more prosperous future.

FAQ

What is an ATM card?

An ATM card, also known as a debit card, is a plastic card issued by a bank that allows you to access your bank account electronically. It can be used to withdraw cash from ATMs, make purchases at merchants, and perform various banking transactions.

How can an ATM card provide financial freedom?

An ATM card provides financial freedom by allowing individuals to access their funds at any time and from anywhere. It eliminates the need to carry large amounts of cash, provides convenience for making purchases, and enables easy management of personal finances.

What are the advantages of using an ATM card?

Using an ATM card offers several advantages. Firstly, it provides easy and quick access to cash. Secondly, it eliminates the risk of carrying large sums of money. Thirdly, it allows for convenient online and in-store purchases. Lastly, it enables tracking of expenses through bank statements and online banking systems.

Are there any fees associated with using an ATM card?

Yes, there can be fees associated with using an ATM card. These fees may include ATM withdrawal fees, transaction fees for certain types of transactions, and overdraft fees if the account balance goes below zero. It is important to check with your bank or financial institution to understand the specific fees associated with your ATM card.

How can one apply for an ATM card?

To apply for an ATM card, you can visit your bank or financial institution and inquire about their card options. They will provide you with an application form that needs to be filled out. You will also need to provide identification documents, such as a passport or driver's license, and proof of address. The bank will then process your application and issue you an ATM card once approved.